Hyperstition #15 — May 21, 2025

Hibachi 'Temp Markets', Pump.fun memecoin runners and more.

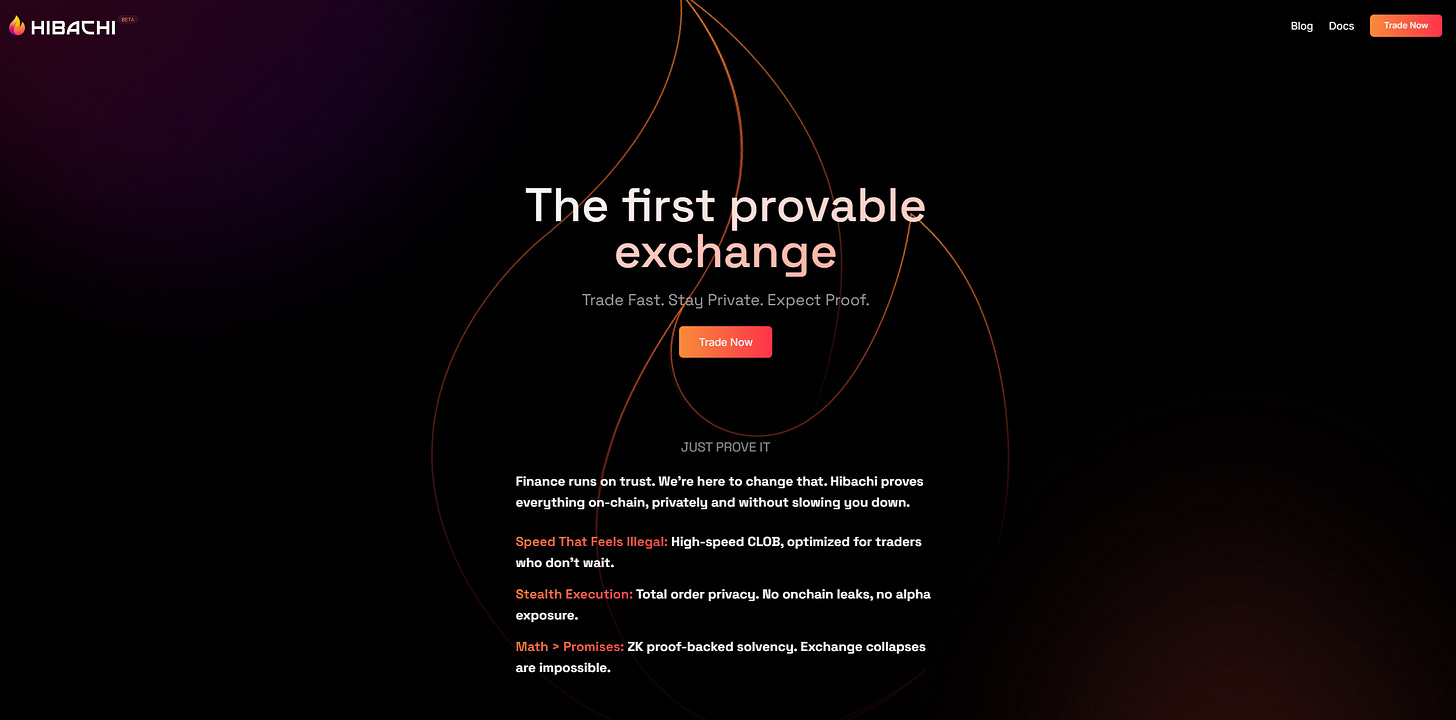

Hibachi: The first provable exchange (Sponsored)

Hibachi isn’t just another decentralized exchange (DEX).

It’s the first provable exchange — and it’s setting a new standard for what trading should be.

Hibachi has built something different: a platform that combines the fast execution of off-chain order books with the mathematical certainty of on-chain verification.

The approach is straightforward. It uses a custom off-chain central limit order book (CLOB) for speed and then settles batched trades on-chain with zero-knowledge (ZK) proofs for security.

User funds remain fully verifiable through smart contracts, establishing what should be the new standard for all exchanges: proof of solvency.

Temp Markets

Let's talk about one of Hibachi's coolest innovations: Temp Markets.

Unlike other exchanges that maintain hundreds of stagnant markets regardless of volume, Hibachi has created a dynamic system that evolves with trader demand.

Temp Markets are cyclically introduced and removed based on what people are actually trading.

What makes Temp Markets unique?

These time-limited contracts function similarly to standard perpetual futures but operate on a flexible timeline.

Rather than relying on arbitrary expiration dates, Temp Markets respond to engagement.

Markets showing consistent volume get extended, while those losing momentum are delisted, with all positions systematically settled at the final mark price.

For the user this means:

Concentrated Liquidity: By directing trading activity toward a curated selection of high-demand assets, Temp Markets generate deeper order books with narrower bid/ask spreads alleviating fragmented liquidity.

Actual Market Relevance: This systematic rotation ensures traders consistently access assets with current market momentum. New markets are regularly introduced while underperforming assets are methodically rotated out.

Community-Driven Selection: Hibachi is always listening. Users have an active say in the assets that get listed.

Temp Markets create a trading environment where liquidity is optimized, market selection remains relevant, and traders benefit from both privacy and provability.

This is one of many unique features of Hibachi. After speaking with the team, one thing is clear — Hibachi was built by traders and everything they do is from the angle of creating the best user experience on the market.

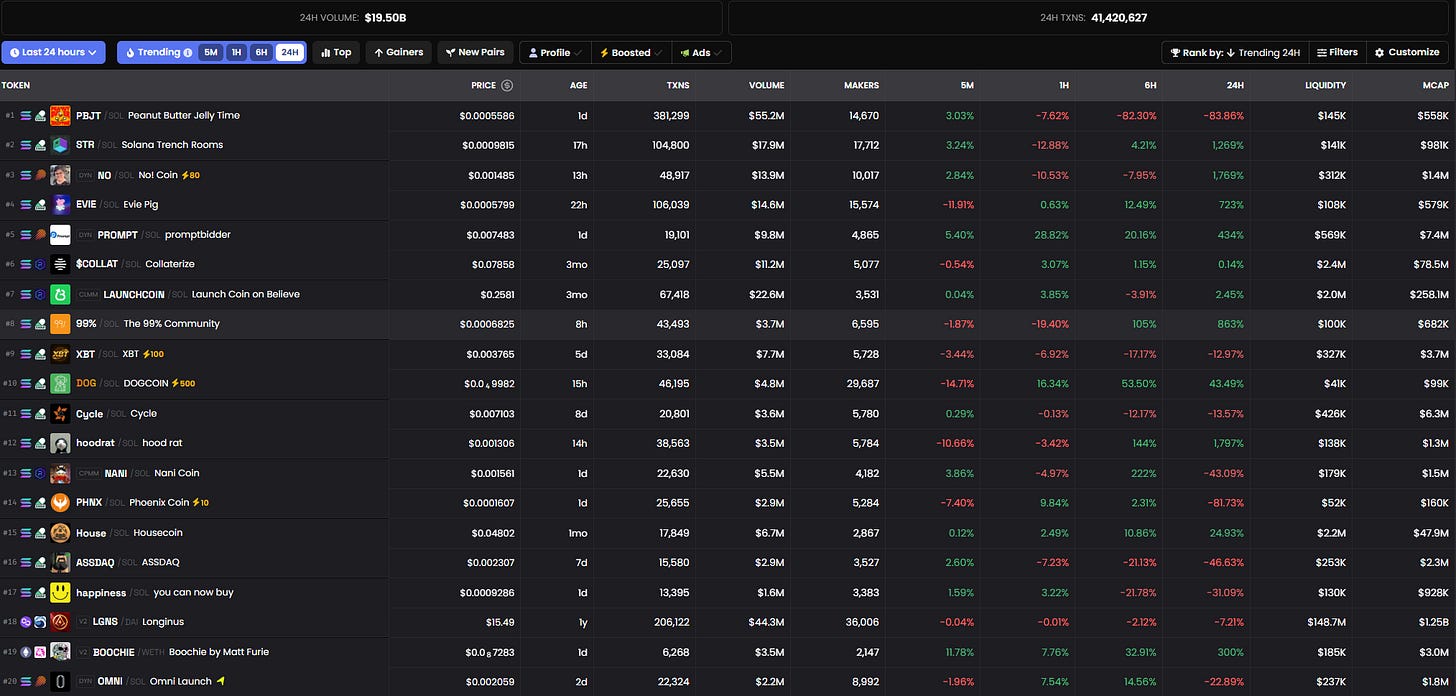

Meme performance on Pump.fun: PBJT, Solana Trench Rooms, and Evie Pig explode (and implode)

In the past 48 hours, three standout tokens on Pump.fun — Peanut Butter Jelly Time (PBJT), Solana Trench Rooms (STR), and Evie Pig (EVIE)— offered a masterclass in viral hype, instant wealth (for a few), and gut-wrenching dumps.

Each rode a unique memetic wave, surged to millions in market cap, and then bled fast. Here’s a breakdown.

PBJT: Banana meme nostalgia goes nuclear

PBJT tapped into the early-2000s “Peanut Butter Jelly Time” internet meme, which features a dancing banana with a chaotic song.

That throwback vibe, paired with Pump.fun’s rapid-fire minting mechanics, saw the token rocket to a peak market cap of nearly $59 million within hours of launch. But just four hours later, it had dropped nearly 80%, crashing to the $4–5 million range.

Daily volume topped $50 million, and over 338,000 trades cycled through PumpSwap. Social media sentiment was euphoric during the rise—PBJT trended on crypto Twitter, with meme accounts celebrating 100x gains. Influencers and call groups reportedly flagged it early; one claimed a 138x win for followers.

On-chain, PBJT showed typical early concentration. The creator wallet held ~6.7% of supply, though 86% of LP tokens were locked. Post-dump sentiment turned skeptical, as wallets believed to be insiders offloaded heavy bags.

Solana Trench Rooms: Degens in the trenches

Solana Trench Rooms (STR) drew on a cultural inside joke among Solana users: being “in the trenches” of market action. It offered a vague but resonant identity to degens who’ve stuck through bear markets and rug pulls.

That emotional pitch helped STR pump from ~$50K to $1.3 million in market cap, only to slide back to ~800K four hours later.

STR saw $17M in volume and nearly 100K transactions in its first half-day. It became a rallying point for Solana natives on Twitter, where hashtags like #SolTrenches and #TrenchBorn emerged.

As price cooled, some users called out suspicious early wallet behavior, alleging insider dumps. While the token was fairly launched via Pump.fun, a few wallets holding 2–3% each exited during peak liquidity.

Despite the drama, STR’s core fans stayed loyal, sharing war-themed memes and promising to “hold the trenches” into the next cycle.

Evie Pig: Peppa Pig enters the sh*tcoin chat

Evie Pig (EVIE) capitalized on a viral pop culture event: the children’s cartoon Peppa Pig introducing a new character, “Evie Pig.” Crypto Twitter and TikTok seized on the moment, with some 27 million TikTok views on the topic in a single day.

Traders minted EVIE and drove it to a $3.1 million market cap, with a peak price of $0.003145. Four hours later, the price had collapsed nearly 80%, stabilizing around a $600K cap. Still, that was enough time for early buyers to secure huge returns. Volume reached $14 million, and over 3,900 holders cycled in within 24 hours.

Social sentiment was electric: Pig memes, Peppa references, and influencer nods flooded timelines. EVIE felt culturally “bigger” than the average Solana memecoin, thanks to its connection to mainstream children’s media.

Fortunately, it wasn’t a rug: the mint was renounced, and the LP was mostly locked. But the novelty wore off fast, and so did the price.

The meme market moves fast

Each token demonstrated the speed at which crypto turns memes into millions and then back into dust.

PBJT reached historic caps but couldn't escape its own gravity. STR became a cult moment for Solana loyalists before retracing hard. EVIE proved that even children’s cartoons aren’t safe from tokenization.

Trading memecoins on Pump.fun remains a high-risk, high-reward game. Most buyers are playing musical chairs — with the soundtrack switching from meme songs to exit liquidity before you know it.

(Credit to @mynt_josh for the embedded videos!)

By the numbers…