Hyperstition #16 — May 22, 2025

Bitcoin taps all-time high, priming altseason.

Bitcoin taps all-time high, priming altseason

Bitcoin tapped $111,500 on May 22, smashing January highs.

Meanwhile, Bitcoin Dominance is declining and stablecoins are rotating into alts.

Institutional inflows and macro unease could delay a true altseason until later in the year, but memecoins are already outperforming.

Bitcoin set a new all-time high Wednesday, ending a months-long stint of consolidation in the cryptocurrency markets and setting the stage for an altcoin rally in the second half of 2025.

In the early hours of May 22, Bitcoin’s spot price surpassed $111,500 per coin, smashing its January record top of roughly $109,000, according to data from CoinGecko.

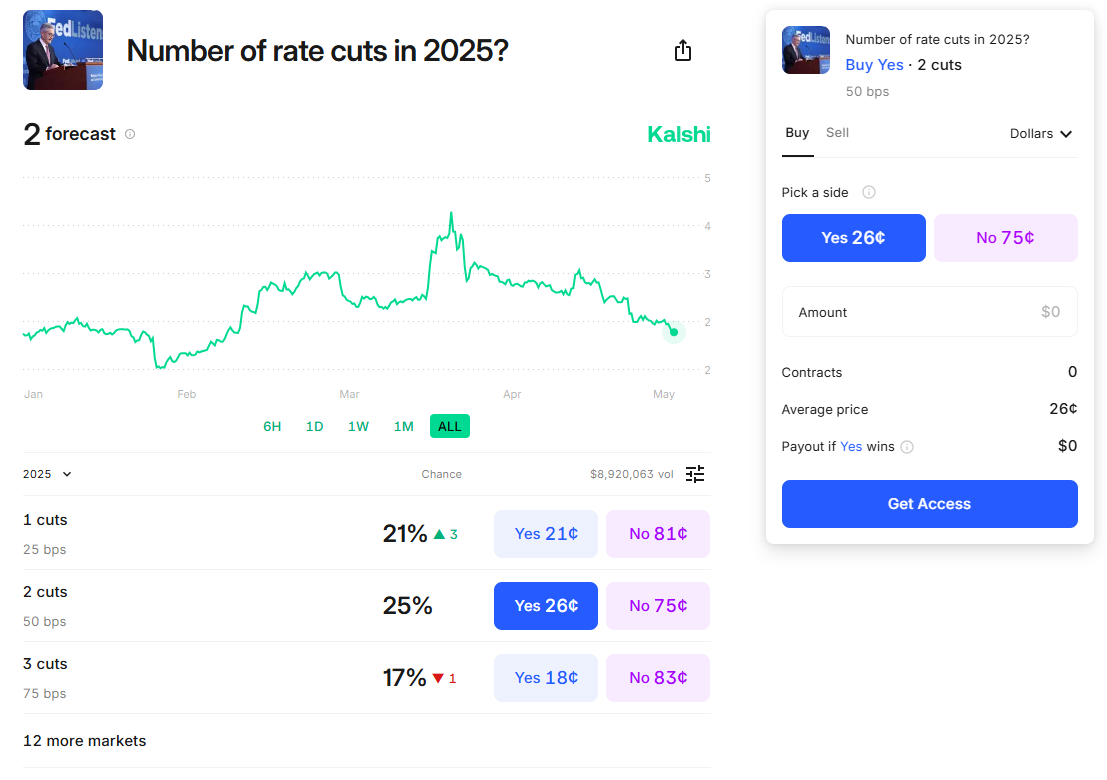

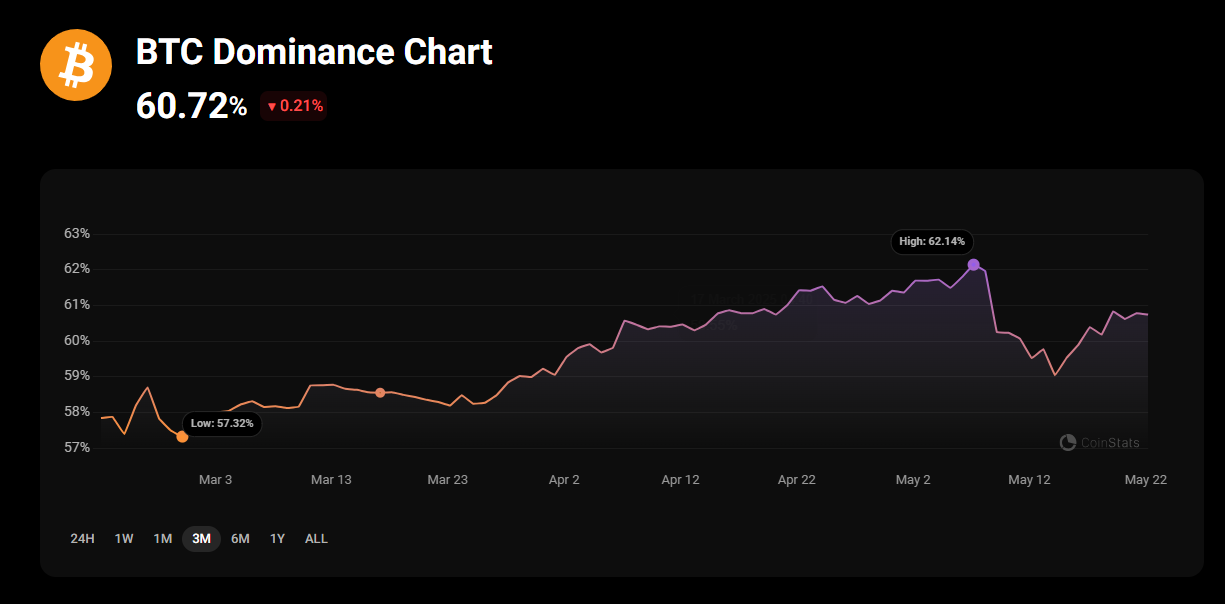

But even as the OG cryptocurrency rallied, Bitcoin Dominance — a measure of Bitcoin’s share of crypto’s total market capitalization — has steadily declined.

As of May 22, the metric stands at approximately 60.75%, down from a cyclical high of more than 62% on May 7, according to data from CoinStats.

Analysts say this setup often precedes a transition to altseason, when smaller-cap cryptocurrencies outperform core cryptos such as Bitcoin and Ether.

“Not gonna lie, this is the vibe before a massive altseason,” crypto influencer Route 2 FI said in a May 22 X post. “Please let it happen.”

Bitcoin price discovery

However, relentless institutional Bitcoin inflows and macroeconomic unease could delay a broad altcoin rally until later in the year.

“Not expecting a mind-blowing altcoin rally before Q4 2025,” market researcher CryptoVerse Explorer said in a May 21 X post.

“Based on global liquidity trends, altseason should begin in Q4 2025 and wrap up by Q2 2026,” the researcher added.

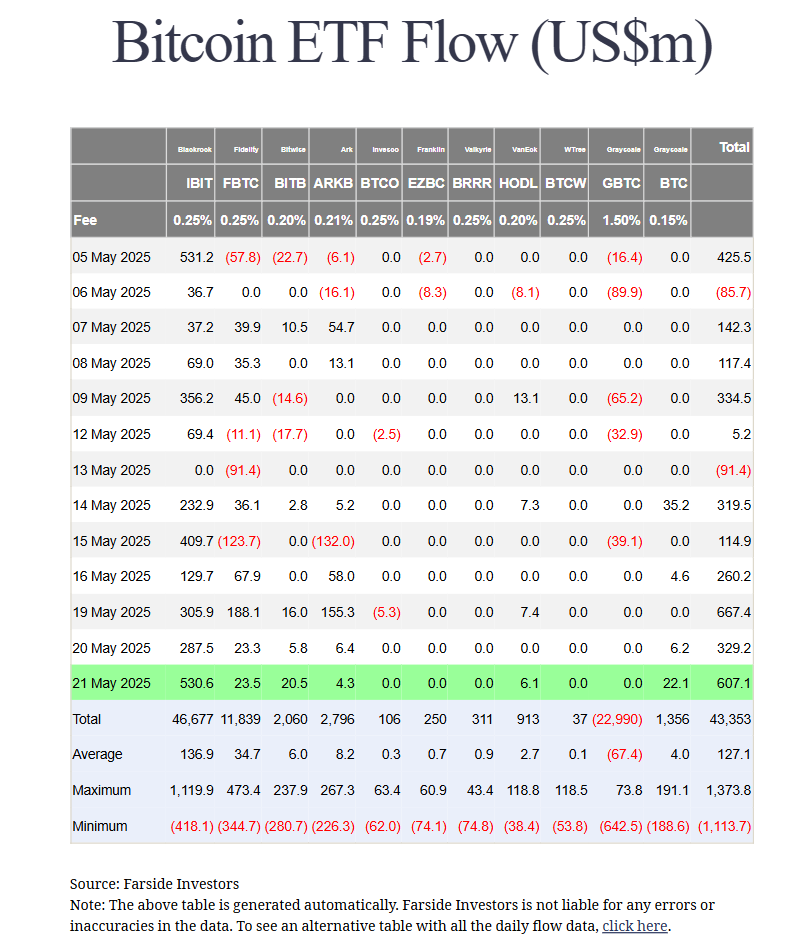

Since Monday, Bitcoin exchange-traded funds (ETFs) have drawn more than $1.6 billion in inflows, according to data from Farside Investors.

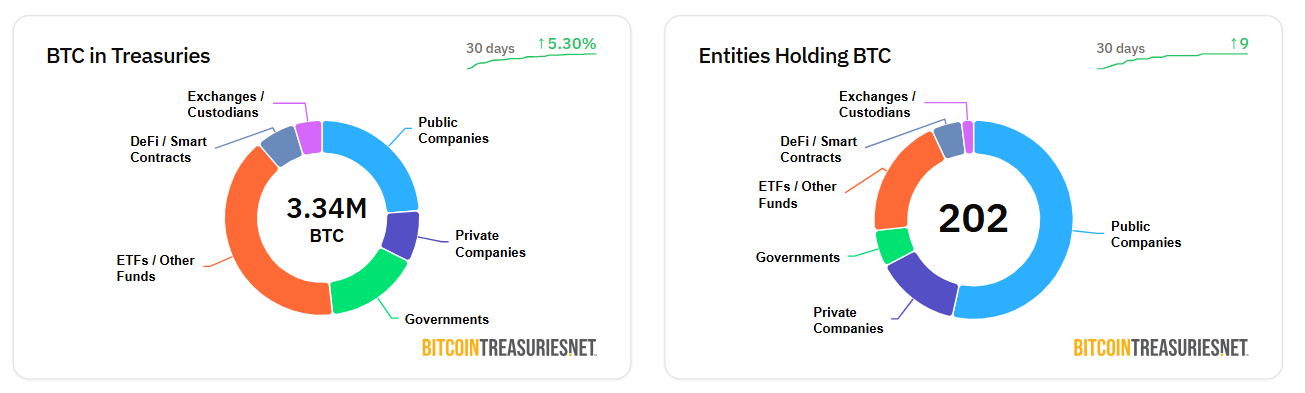

Corporate treasuries also keep gobbling up the cryptocurrency. As of May 22, publicly-traded companies hold nearly $90 billion worth of Bitcoin reserves, according to data from Bitcointreasuries.net.

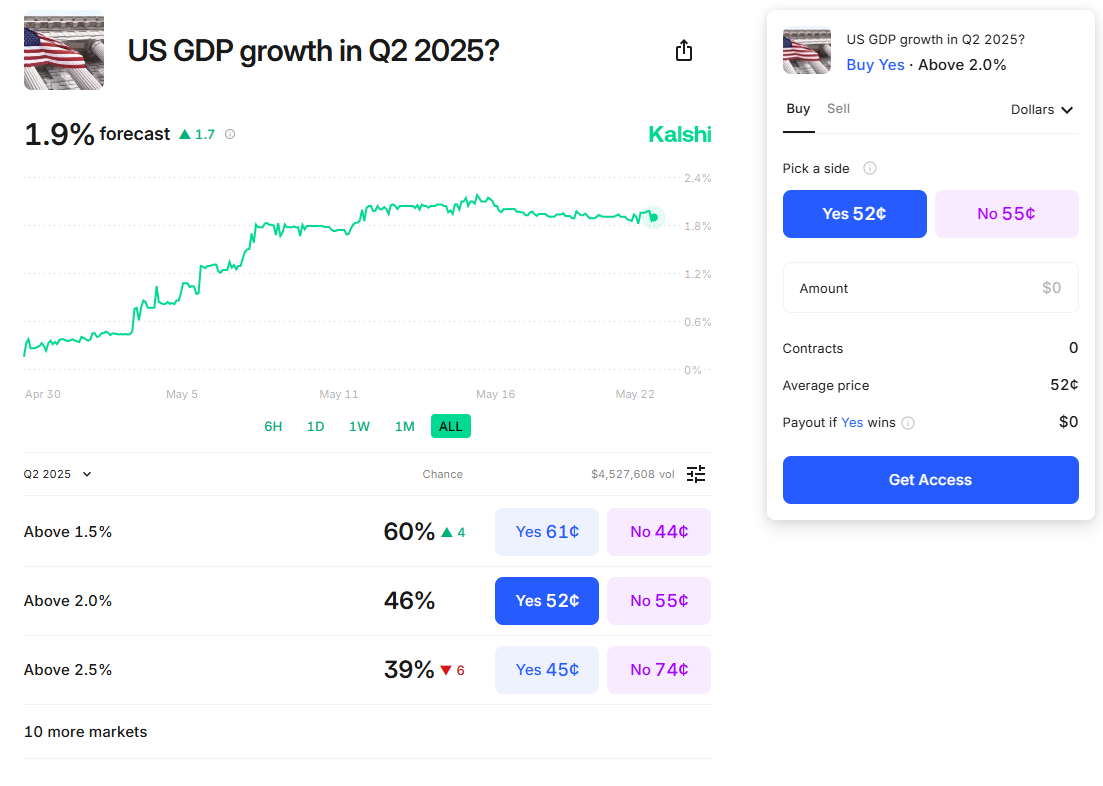

These inflows are only accelerating as macroeconomic conditions deteriorate, especially in the US.

On May 21, yields on 30-year US Treasury bond broke 5% for the first time since 2023. Meanwhile, Moody’s, a credit researcher, has downgraded its rating for US debt from a pristine Aaa to Aa1 for the first time in its more than 100-year history.

“As Bitcoin continues into price discovery, it tends to absorb much of the market’s liquidity,” Mena Theodorou, co-founder of Australian exchange Coinstash, told Decrypt.

“We’re more likely to see strength appear in select altcoins and sectors, rather than a broad-based rally.”

Early movers

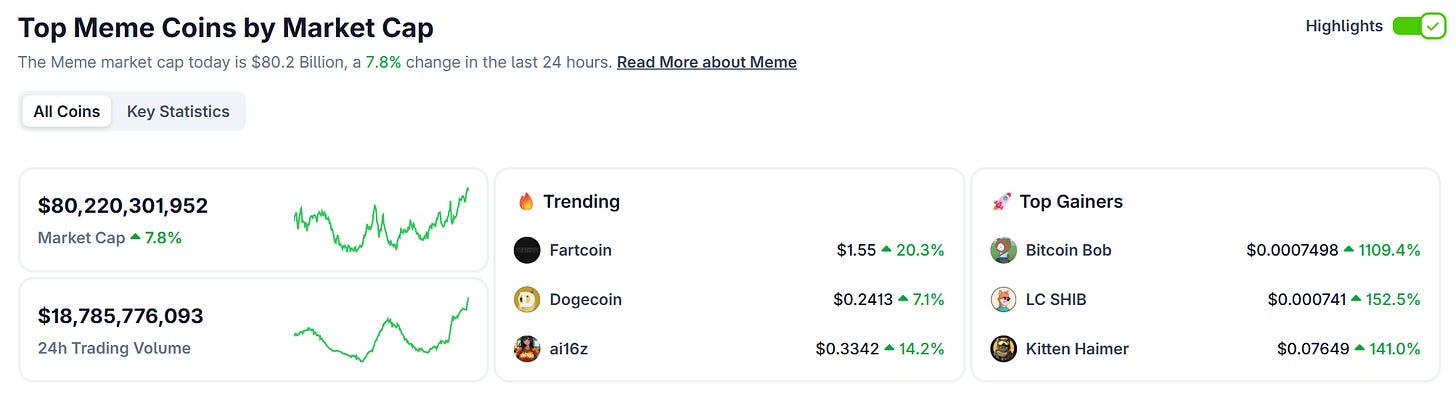

Still, memecoins — one of altseason’s strongest bellwethers — are already outperforming.

The total memecoin market cap has risen nearly 8% in the past 24 hours, trouncing Bitcoin’s roughly 4.2% gains during the same period, according to CoinGecko.

Stablecoin dominance has also declined, according to data from TradingView. As of May 22, stablecoin Tether’s (USDT) share of crypto’s market cap stands at around 4.4%, down from more than 6% in April, the data shows.

This indicates on-chain capital is moving from the sidelines into riskier assets, and typically into altcoins.

“Alts could outperform BTC over the next 6-8 weeks but this won't be a full-blown Altseason but rather a relief rally,” crypto influencer Ash Crypto said in May 21 X post.

By the numbers