Hyperstition #18 — May 26, 2025

Kalshi preps Web3 buildout, HYPE hits all-time high, and more.

Kalshi prepares ‘aggressive’ Web3 buildout

The regulated US prediction market started taking SOL deposits on May 23.

Now, Kalshi is working on deeper crypto integrations — including posting transactions on-chain and supporting decentralized applications (Dapps).

Kalshi is aggressively expanding its Web3 capabilities in a bid to onboard crypto-native users and eventually cultivate an ecosystem of on-chain applications, its CEO said Friday during Solana’s Accelerate 2025 event in New York.

On May 23, the regulated US prediction marketplace said users can now offramp Solana (SOL) from on-chain wallets directly into Kalshi trading accounts.

Kalshi has been taking deposits in USDC (USDC) and Bitcoin (BTC) since October and March, respectively. It uses crypto payments service ZeroHash for crypto-to-fiat offramping.

“There’s a large amount of liquidity on-chain, and companies like ours want to go where the user is,” Tarek Mansour, Kalshi’s CEO, said. “We’re leaning in aggressively,” he added.

Kalshi’s crypto rails mark its first steps towards a broader vision for Web3 integration that includes posting trading data on-chain and eventually supporting third-party decentralized finance (DeFi) apps, according to Mansour.

“There’s a large application layer that can be built on top of prediction markets and the data we generate,” Mansour said, adding that he “can’t think of a better ecosystem for that than Solana.”

Untapped market

Founded in 2018, Kalshi runs an off-chain derivatives exchange that lets users bet on everything from election outcomes, to sports events, to Rotten Tomatoes film ratings.

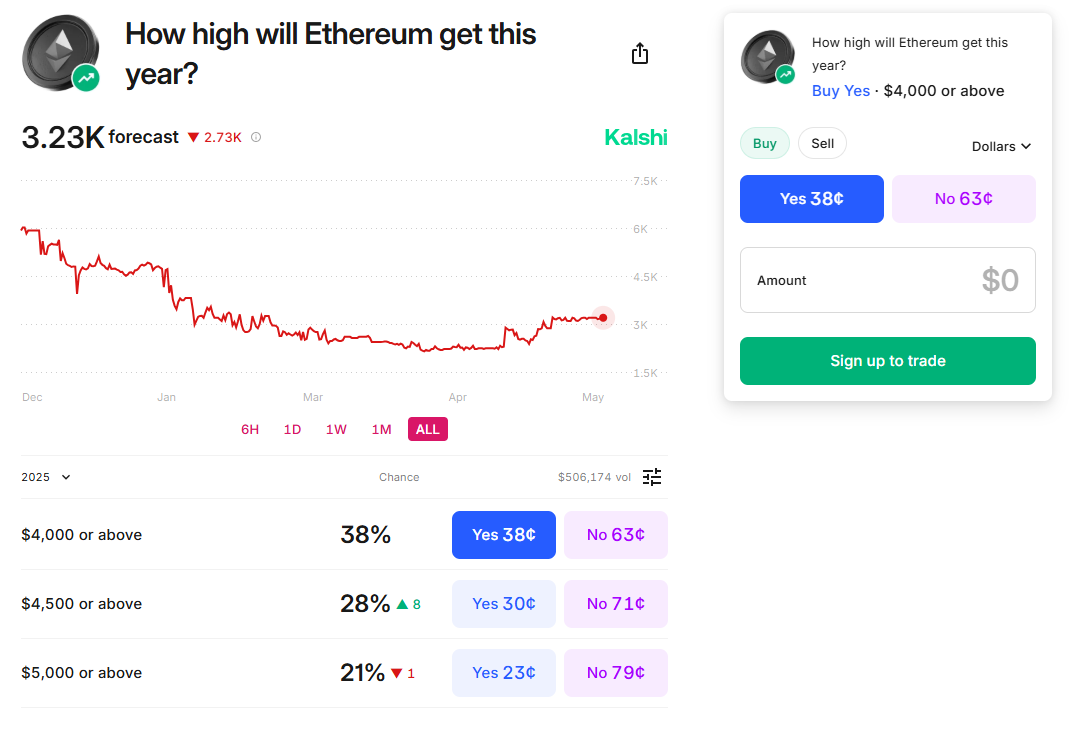

Kalshi’s cryptocurrency contracts are especially popular. Its market for betting on Bitcoin’s hourly closing price has seen nearly $175 million in trading volume since launching earlier this year, according to Kalshi’s website.

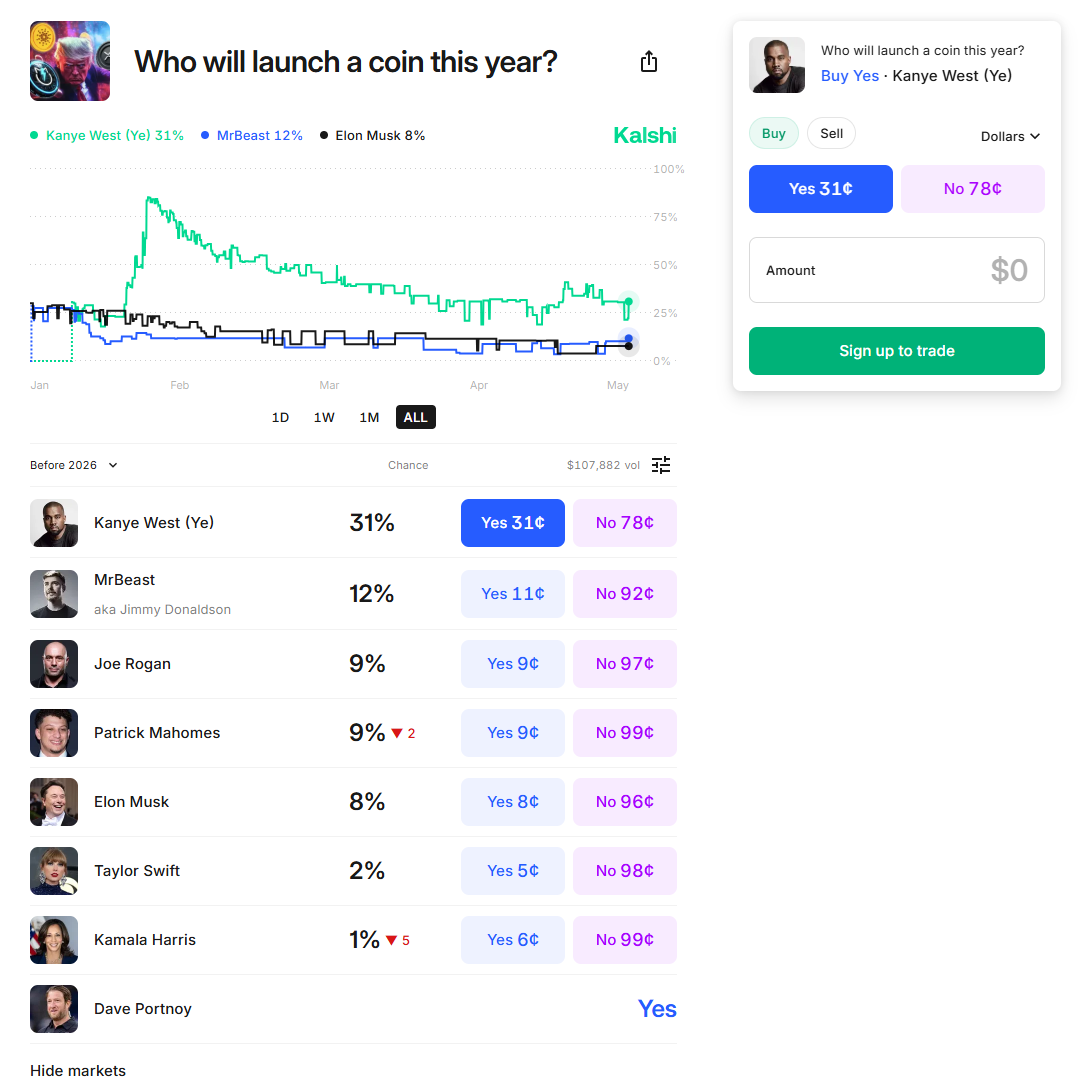

It also runs markets for betting on whether US President Donald Trump will create a national Bitcoin reserve, if federal lawmakers will pass a cryptocurrency bill, and if Kanye West will launch a memecoin.

The US prediction market started adding crypto payment rails last year.

It has tough competition for crypto-native traders from rival Polymarket, a prediction marketplace built on Ethereum side-chain Polygon.

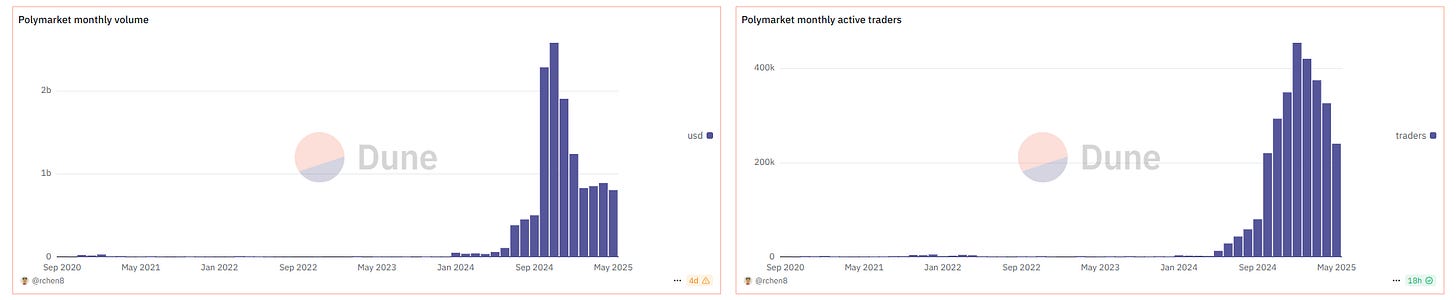

Polymarket is the world’s most popular election betting venue, clocking more than $3 billion in trading volume tied to the US presidential race in November.

It logged more than $800 billion in trades during the month of May, according to data from Dune analytics.

Despite Polymarket’s success, its native network Polygon has been losing market share to other chains.

Polygon’s total value locked (TVL) has declined from roughly $5 billion in 2022 to less than $1 billion as of May 26, according to data from DeFiLlama.

Meanwhile, Solana has emerged as the most popular blockchain network for retail traders. Its nearly $10 billion in TVL is second only to Ethereum’s, the data shows.

Solana still doesn’t host a flagship prediction marketplace. This could quickly change as exchanges such as Kalshi ramp up in Web3.

“Solana is the system of choice because its trader-friendly,” Mansour said.

“We’ve always wanted to be in [crypto],” he added. “Now… the regulatory environment enables us to get into [it].”

In other news…

HYPE sets new all-time high, nearing $40 per coin

Hyperliquid’s native HYPE token set a new all-time high of nearly $40 per coin over the weekend, according to data from CoinMarketCap. The rally signals confidence in Hyperliquid’s ability to scale protocol revenues and expand its decentralized finance (DeFi) presence beyond perpetual futures trading. Its smart contract platform, HyperEVM, has onboarded nearly $1.5 billion in TVL since launching in February, according to data from DeFiLlama.

Court clears Mango exploiter of fraud convictions

On Friday, a US judge overturned convictions against Avraham Eisenberg, who was previously found guilty of exploiting Solana exchange Mango Markets for $110 million. Judge Arun Subramanian ruled there was insufficient evidence that Eisenberg made false statements or illegally manipulated the platform’s code. The ruling may signal a shifting stance on DeFi-related enforcement under the Trump administration.