Hyperstition #2 — May 2, 2025

HYPE reclaims $20 on HyperEVM inflows, Boopdotfun stirs KOL-coin mania, Loopscale to restore vault withdrawals, and more.

HYPE reclaims $20 on Staking Tiers, HyperEVM inflows

Hyperliquid’s native HYPE token has reclaimed $20 per coin for the first time since March as traders eye the network’s impending staking upgrade and a spike in activity on its HyperEVM smart contract platform.

As of early trading on May 2, the HYPE token had a market capitalization of approximately $6.8 billion and a fully diluted value (FDV) of more than $20 billion.

The rally signals renewed confidence in Hyperliquid’s ability to scale protocol revenues and expand its decentralized finance (DeFi) presence beyond perpetual futures trading.

Growth Pressure

Hyperliquid has been under pressure to deliver on lofty growth plans ever since a historic post-airdrop rally sent the HYPE token’s FDV as high as $35 billion in December.

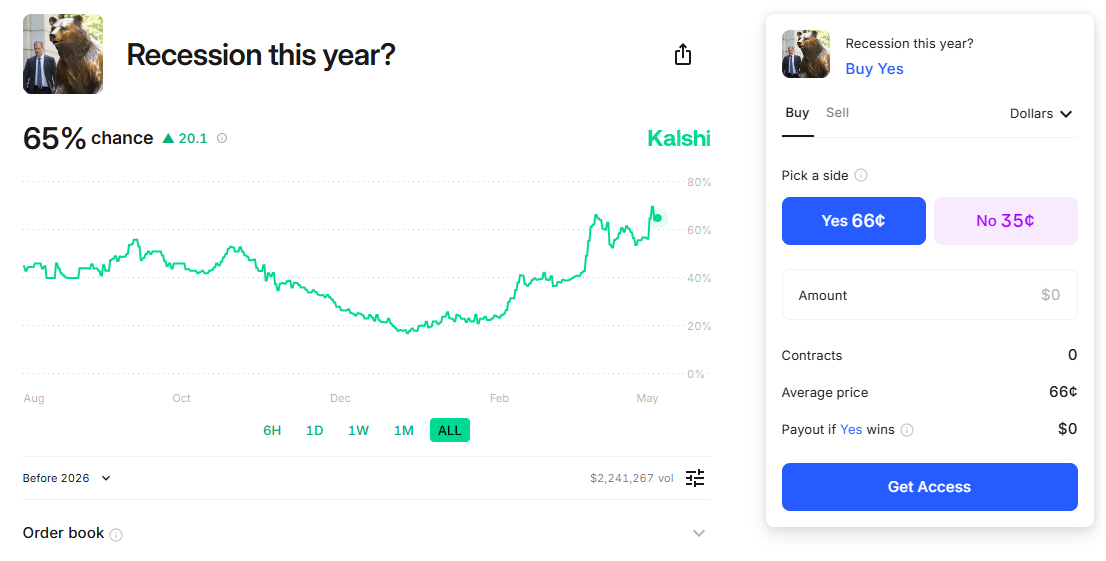

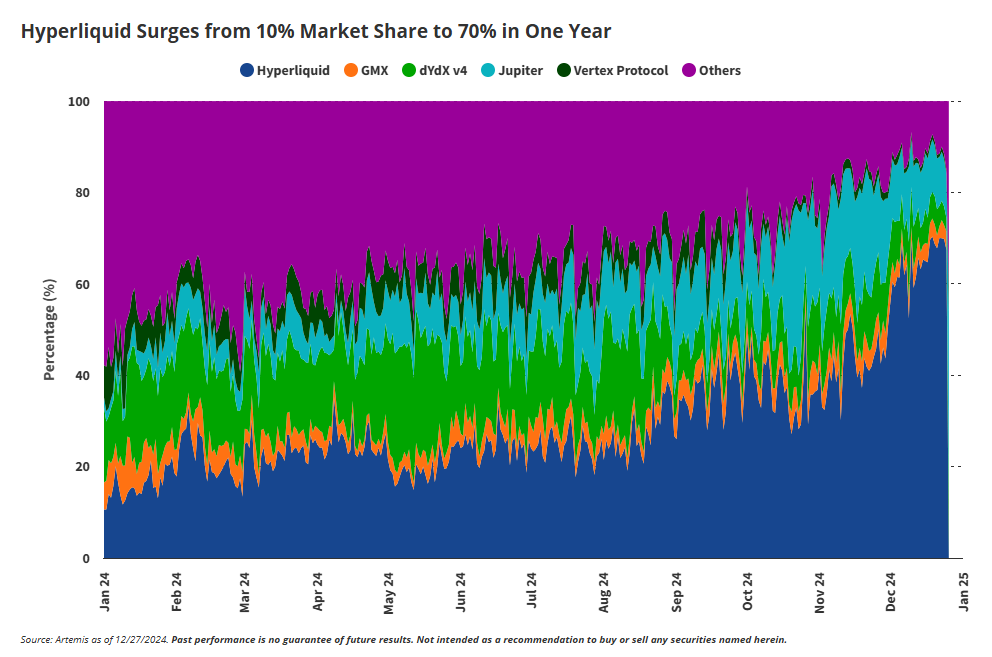

Since launching in 2023, the network’s HyperCore derivatives exchange has captured approximately 70% of on-chain perpetual futures trading volumes, according to asset manager VanEck.

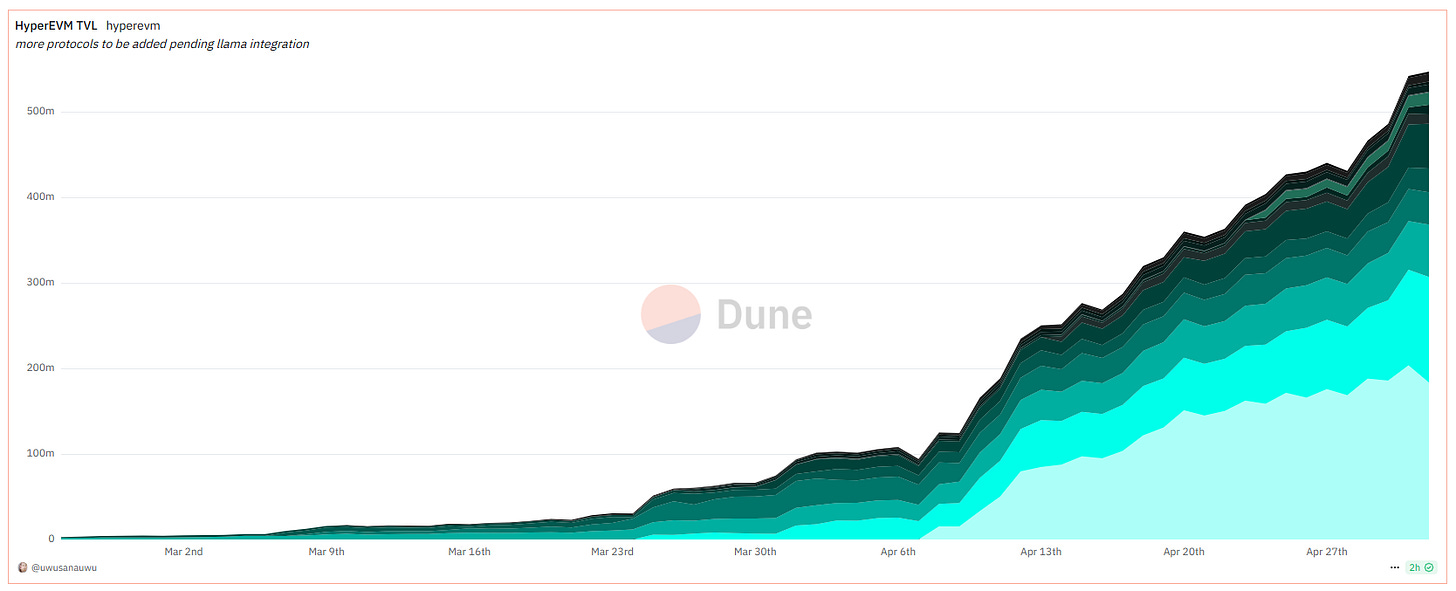

But HyperEVM initially struggled to gain traction, clocking only around $20 million worth of TVL inflows in the month after its February launch, per Dune Analytics.

“Hyperliquid has built a growth story founded upon becoming a general-purpose blockchain that will accommodate other applications besides its ‘hyper’ successful Perp DEX,” VanEck said in a January research note.

“If Hyperliquid is unable to meet the growth expectations of its community, the prisoner’s dilemma facing many newly rich $HYPE holders may quickly unravel.”

HyperCore is a bespoke blockchain protocol specializing in spot and perpetual futures trading. HyperEVM is a permissionless smart contract platform based on Ethereum’s virtual machine. Both use Hyperliquid’s validator set.

Staking Tiers

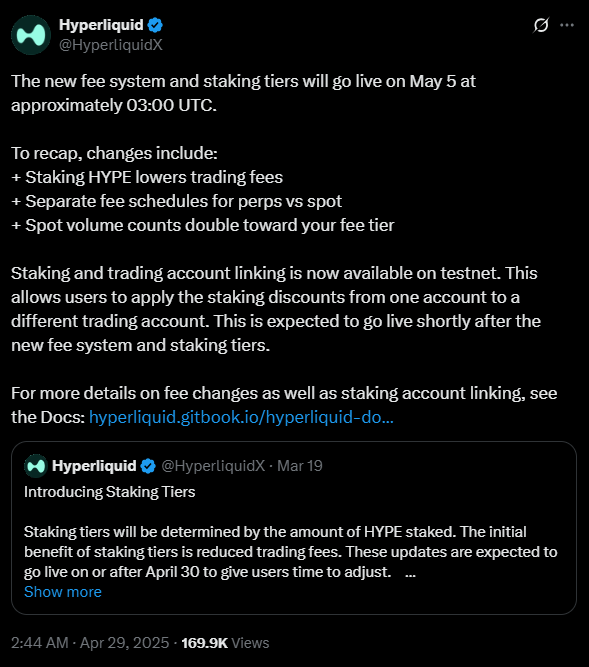

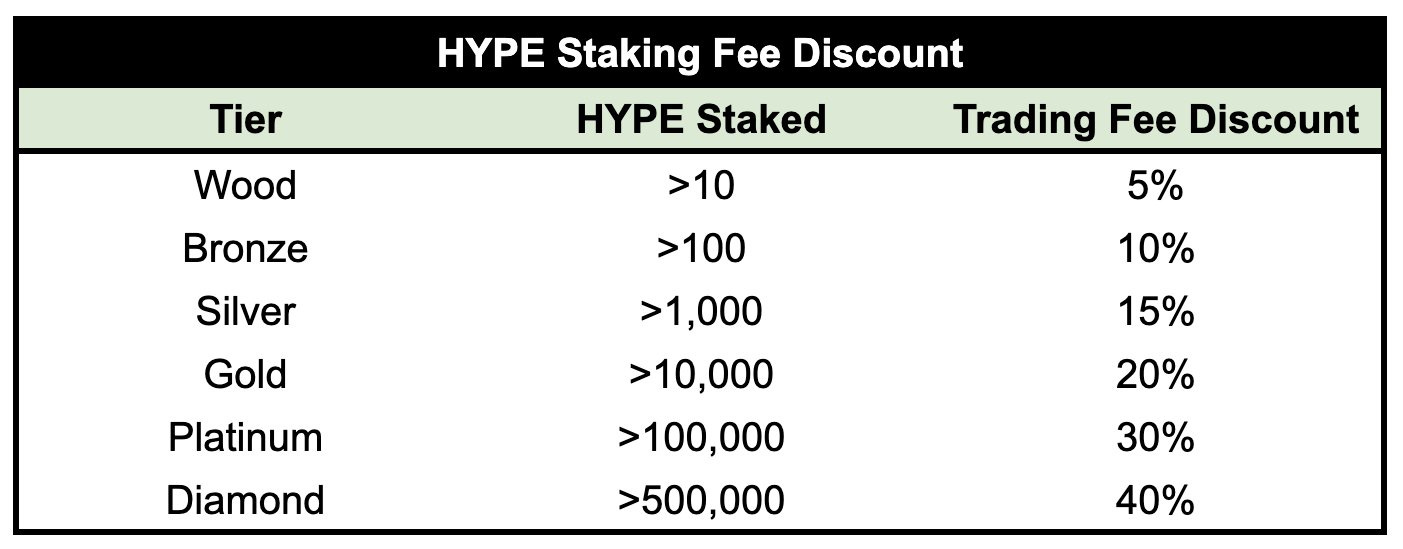

On April 29, Hyperliquid tipped plans to roll out a staking upgrade next week designed to cut trading costs for HYPE stakers and boost the protocol’s overall fee revenue.

Starting May 5, HYPE stakers can earn fee discounts of up to 40% on Hyperliquid’s core spot and perpetuals exchanges. Baseline trading fees are increasing from 3.5 basis points (bps) to 4.5 and 7 bps for perps and spot traders, respectively.

HyperEVM Inflows

On April 30, the network’s HyperEVM smart contract platform surpassed 10,000 daily active users and $500 million in TVL, according to Dune Analytics.

The uptick largely reflects the success of native DeFi protocols HyperLend and Felix. The lending protocol and stablecoin minter have collectively bootstrapped more than $300 million in TVL since launching roughly one month ago, according to DeFiLlama.

Value Accrual

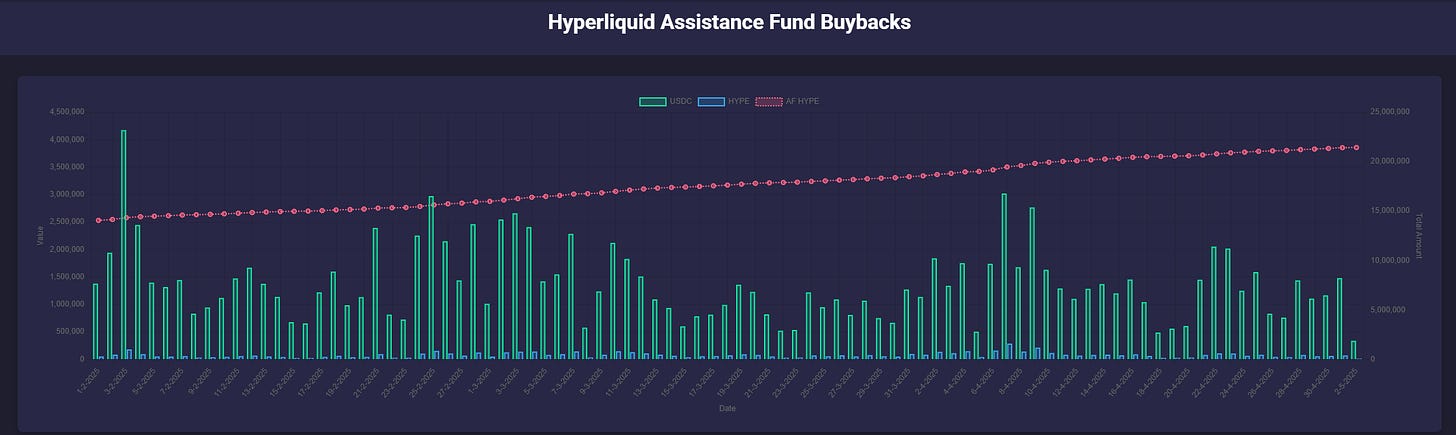

Rising trading fees and TVL inflows promise to accelerate Hyperliquid’s token buybacks, the primary value accrual mechanism for HYPE holders.

On May 1, Hyperliquid repurchased nearly $1.5 million worth of HYPE tokens, translating to an annualized run-rate of nearly $550 million. The question now is whether Hyperliquid can sustain its momentum.

In Other News…

Boopdotfun stirs KOL-coin mania

On May 1, PancakeSwap founder dingaling launched Boopdotfun, adding to the litany of upstart launchpads vying for a share of Solana’s memecoin market. Its native BOOP token has surged as high as $500 million in market capitalization on promises of distributing trading fees and token allocations to stakers. The launchpad is also offering KOLs BOOP allocations purportedly worth hundreds of thousands of dollars in exchange for launching tokens on the platform.

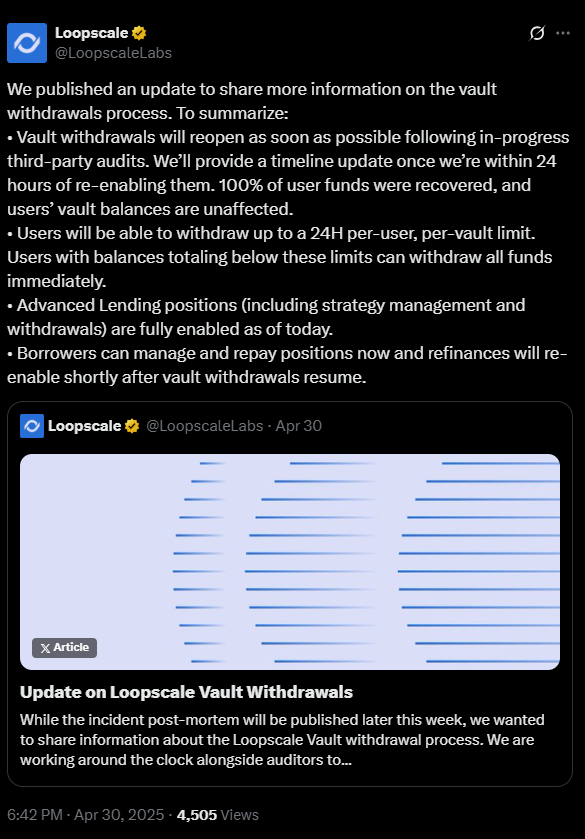

Loopscale to restore vault withdrawals after exploit recovery

On April 30, Solana lending protocol Loopscale announced plans to re-enable vault withdrawals after successfully recovering approximately $5.8 million in USDC and SOL stolen in an April 26 exploit. The DeFi protocol has already restored other lending markets.

By the Numbers…