Hyperstition #21 — May 29, 2025

Believe tips plans for tokenomics flywheel, Daos.fun revamps DAO launchpad, and more.

Believe.app tips plans for tokenomics ‘flywheel’

The startup token launchpad behind Solana’s white-hot Internet Capital Markets (ICM) meta has hinted at plans for a tokenomics “flywheel” to propel growth.

On May 26, Believe.app’s founder, Ben Pasternak, teased the possibility in a cryptic X post featuring a wordless image of a flying tire — an apparent reference to the concept of a value-accruing flywheel in Web3 tokenomics.

The resemblance wasn’t accidental. During a May 27 interview with cryptocurrency influencer Threadguy, Pasternak said Believe “definitely want[s] to build a flywheel” for its community.

“It’s important for rewarding people who contribute positively to the community,” Pasternak said, adding “I have no doubt we’ll do one — we’re in the early planning stages now.”

Still, details remain scarce. For instance, Pasternak hasn’t clarified whether Launch Coin on Believe (LAUNCHCOIN) — the startup launchpad’s de-facto mascot token — stands to benefit from his plans.

As of May 29, the market’s response has been muted.

According to data from DexScreener, LAUNCHCOIN’s market capitalization has been hovering around $175 million. That’s a decline of more than $50 million from May 26, when Pasternak first published his suggestive X post.

Meanwhile, the Flywheel (FLYWHEEL) memecoin — an unaffiliated riff on Believe’s vague announcement — has languished at a market cap of roughly $150,000 after briefly breaking $2 million on May 26.

Virtuous cycle?

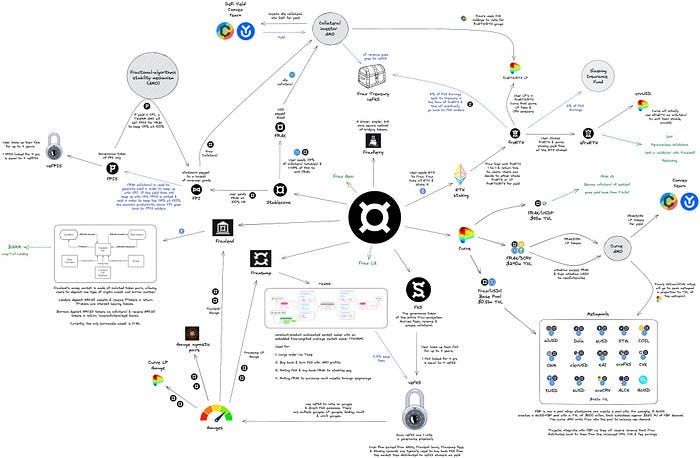

Generally speaking, a flywheel refers to a self-reinforcing value-accrual mechanism embedded in a coin’s tokenomics.

One classic example is algorithmic stablecoin issuer Frax Finance’s original liquidity bootstrapping model, first rolled out in 2021.

The Frax stablecoin’s liquidity providers (LPs) earned yield denominated in the project’s native Frax Shares (FXS) token, which collected a portion of Frax’s protocol revenues.

More liquidity meant more earnings for FXS holders, which in turn strengthened incentives for LPs in a virtuous cycle.

During its heyday in April of 2022, the FXS token’s market cap attained highs of more than $2.2 billion, according to data from CoinGecko.

The devil is in the details…

In theory, Believe could adopt a similar approach.

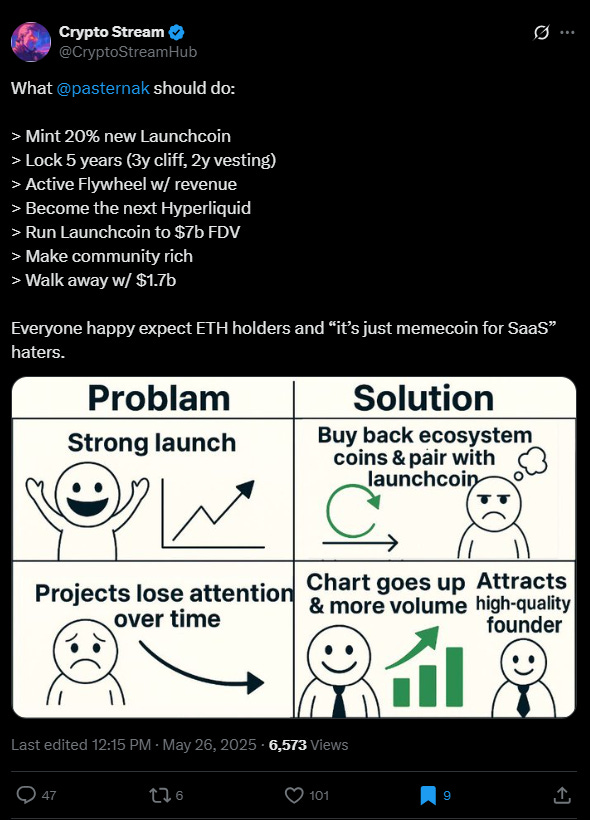

In a May 26 X post, memecoin influencer CryptoStream sketched out one potential model — a token buyback program akin to decentralized exchange Hyperliquid’s.

“Activ[ate] Flywheel w/ revenue > Become the next Hyperliquid > Run Launchcoin to $7b FDV > Make community rich,” CryptoStream said.

That approach has certainly worked for Hyperliquid.

On May 25, Hyperliquid’s native HYPE token hit a record high fully-diluted value (FDV) of nearly $40 billion, according to data from CoinMarketCap.

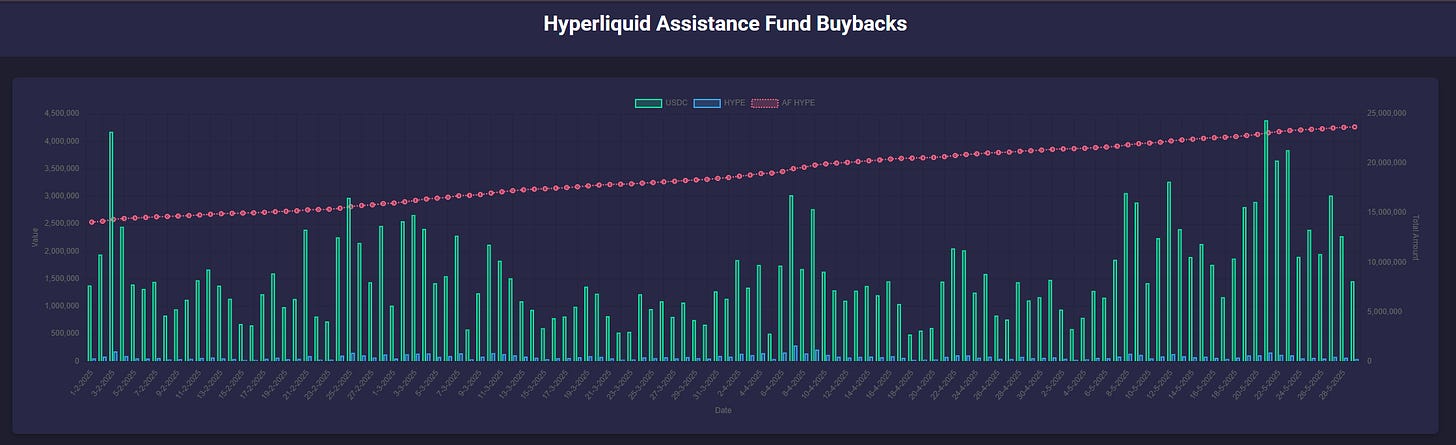

The layer-1 blockchain network — which touts one of the highest revenue-per-employee figures in the world — has been buying back roughly $2 million worth of HYPE tokens daily, according to data from Assistancefund.top.

Believe.app is a small fish by comparison. It clocks roughly $500,000 in protocol fees daily, according to BelieveScreener.

Even so, it’s not hard to imagine a robust buyback program propelling LAUNCHCOIN’s market cap to new highs.

But to get there, Believe.app will need to offer its users more than mysterious X posts.

In crypto, the devil is always in the details.

(Video credit goes to @notthreadguy)

In other news…

Daos.fun now supports permissionless DAO launches

Daos.fun, a Solana launchpad for decentralized autonomous organizations (DAOs), has rolled out a new permissionless model, allowing anyone to create decentralized hedge funds using a bonding curve structure, per a May 28 X post. Previously invite-only, the system now enables users to raise initial capital of $2,000 in SOL, with $8,000 in liquidity bonded at launch. Top-performing traders each week will receive additional liquidity via buybacks and a share of assets under management. A $30,000 prize pool kicks off the first cycle, with funds distributed based on leaderboard rankings.

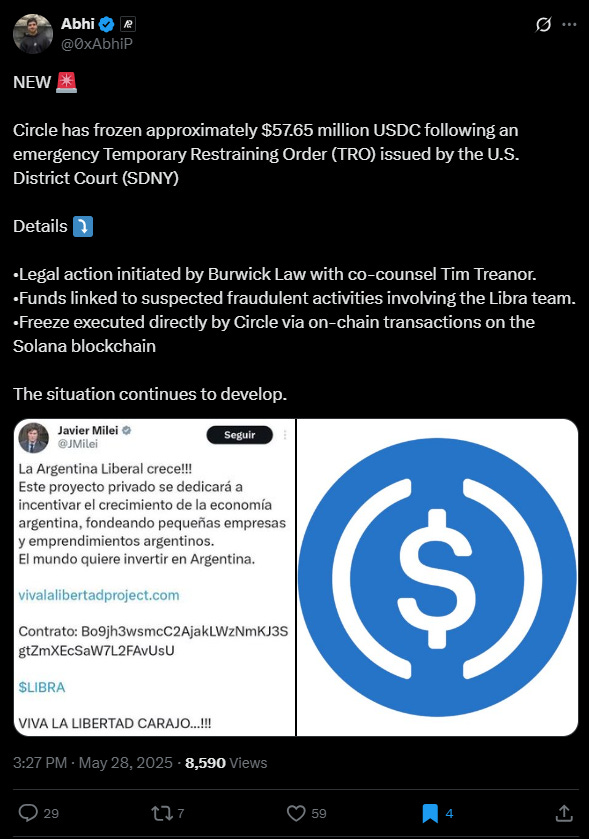

Circle freezes nearly $58M worth of USDC, citing alleged LIBRA ties

Stablecoin issuer Circle has frozen $57.65 million worth of USDC in response to a court order tied to a class-action lawsuit over the Libra memecoin. The suit, filed in the US District Court for the Southern District of New York, alleges the project’s backers misled investors and drained over $100 million from liquidity pools. Libra briefly hit a $4 billion market cap in February after an X post from Argentina’s president — before crashing 94%. A hearing on whether to extend the freeze is set for June 9.

By the numbers…