Hyperstition #23 — June 2, 2025

Loud's noisy token launch, Wynn's $100M loss, and more.

This newsletter issue is authored by Jonathan DeYoung.

Loud debuts native coin following buzzy pre-sale

InfoFi project Loud’s highly anticipated “Initial Attention Offering” took place on May 31 via Hololaunch, with the LOUD token successfully launching following an oversubscribed presale.

The presale was marked by a series of delays that pushed it back by a couple of hours, but once it kicked off, it filled up fairly quickly. The 1,000 most active “yappers” — users who had tweeted about Loud — got a spot in Phase 1 of the presale, while other active Kaito users could jump in for Phase 2.

Phase 1 participants could grab 225,000 LOUD for 0.2 SOL, while those in Phase 2 were limited to 56,250 LOUD for 0.05 SOL after the second round ended up oversubscribed.

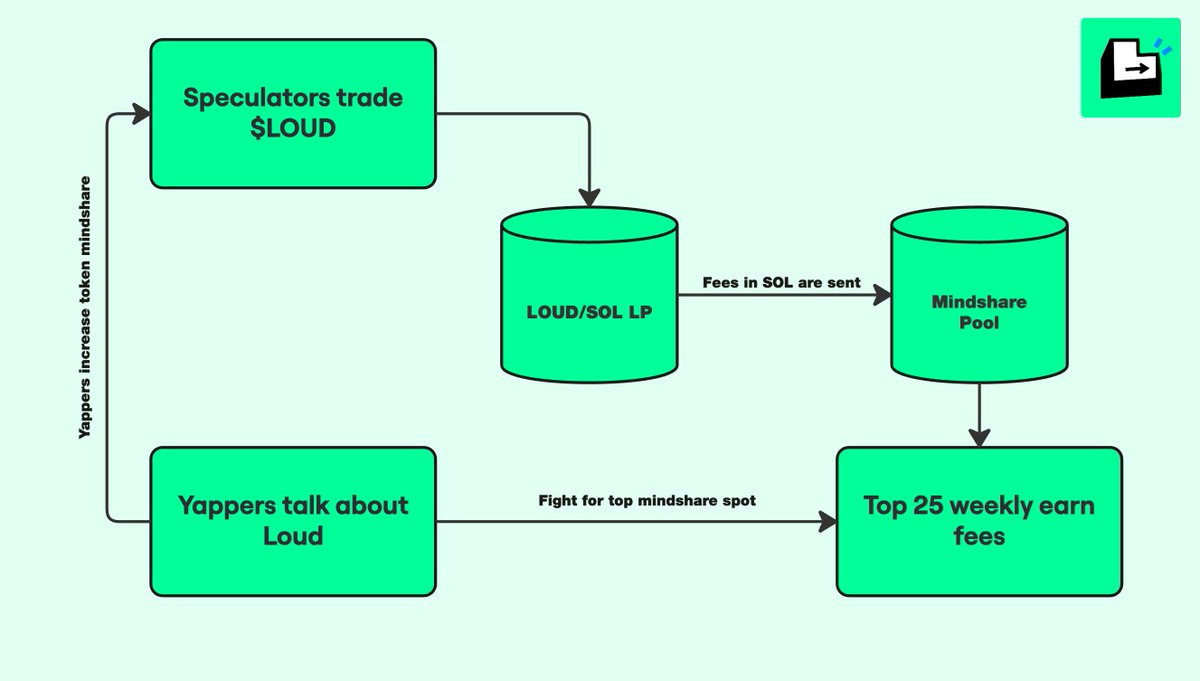

Loud is an attention-focused project built atop Solana that draws heavily from Kaito, which uses AI to track “mindshare,” or the level of attention and engagement projects receive. Loud developer Ultra described it as an “experiment on if attention is really all you need to make something valuable.”

The project is a part of a growing sector within internet capital markets known as InfoFi, or “information finance,” which tokenizes information — attention, in the case of Loud.

According to Kaito, which is a leading player in the space, InfoFi “allows market forces to determine where attention should flow,” increasing efficiency, decentralization and fairness.

In practice, speculators trade the LOUD token on Meteora, which generates liquidity provider fees that are then collected into a “mindshare pool.” Users post about Loud on social media to gain mindshare, and Kaito tracks who the top contributors are.

Every week, the top 25 contributors are paid a share of the SOL fees proportional to their share of mindshare.

Post-TGE performance

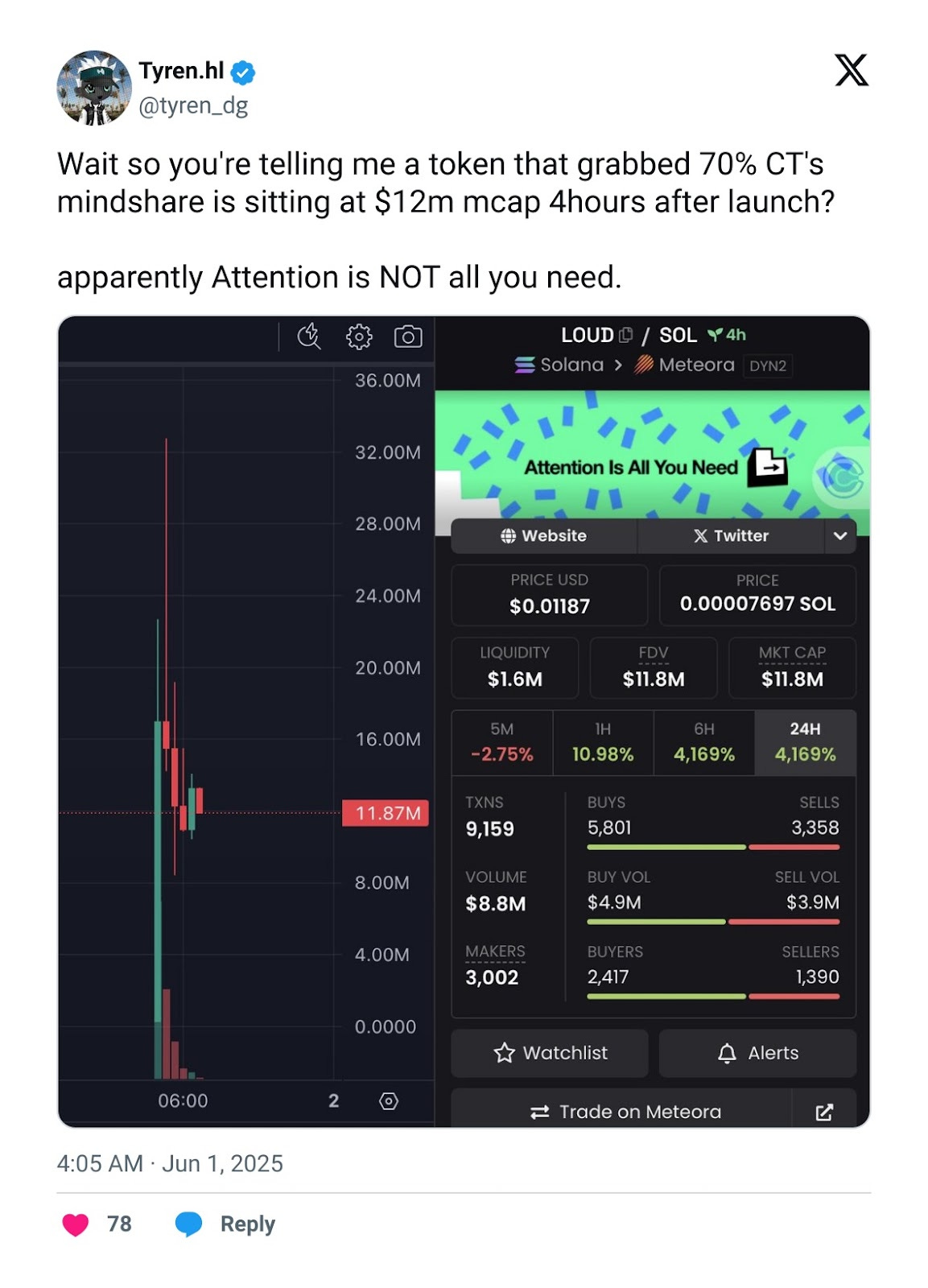

Social media commentators had mixed reactions to the launch. While the token experienced an immediate price explosion after being listed on Meteora, it followed a familiar pattern and quickly fell before generally plateauing.

At the time of writing, LOUD is sitting at $0.0094, up more than 6,600% from its presale price of $0.00014, but down some 70% from its post-launch peak of $0.03276.

This means traders who got in during Phase 1 of the presale turned their roughly $31 worth of LOUD into $7,300 at its peak, and they’d still be holding roughly $2,200 if they didn’t sell at all.

For some on Crypto Twitter, the fact that participants could earn a few thousand dollars just from tweeting proves that the launch was a success and a testament to the earning potential in Web3.

Others couldn’t help but poke fun at the token’s relatively low post-launch market cap, given the amount of attention it has commanded on social media.

Moonrock Capital CEO Simon Dedic wrote on June 1 that LOUD’s fully diluted value (around $13 million at the time) was “way lower than I expected” given the hype surrounding the launch.

However, he found a silver lining in the fact that the lower-than-expected FDV might mean that people care less about speculation and more about fundamentals, since LOUD is marketed as purely experimental.

But Dedic also thought the lack of explosive price action could hint at something odd going on behind the scenes.

According to Hashed data published via Dune Analytics, 43% of Phase 1 claimers and 62% of Phase 2 participants had fully exited their positions by June 1, meaning a number of initial investors are not sticking around to see where the token goes.

Despite this, Loud still commands plenty of mindshare on X, and the experiment is still only getting started.

In other news…

Solana launches App Kit for easier development

Solana has unveiled the Solana App Kit, an open-source Reactor kit built by SendAI and Send Arcade that it says will allow developers to build Android and iOS applications in just 15 minutes.

The Solana Foundation described it as a “base layer for building Solana mobile apps with functional UI,” featuring plug-and-play modules that can be pieced together. The Solana Foundation offered several potential use cases, including building wallet, AI, launchpad and social apps.

Memecoin trader James Wynn liquidated for $100 million

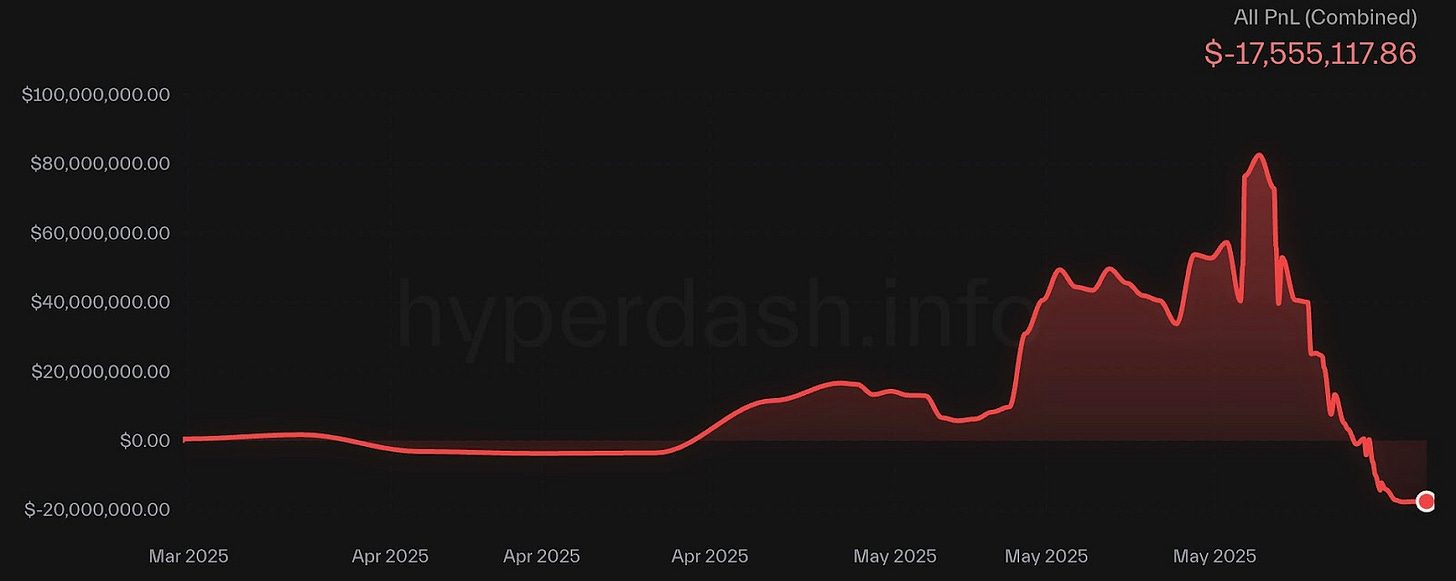

Popular trader James Wynn lost a staggering $100 million after a series of massive, highly leveraged positions in Bitcoin (BTC) and Pepe (PEPE) were liquidated over the past week. His portfolio collapsed from a total P&L of $82.5 million on May 22 to $-17.5 million at the time of writing.

The trader had amassed his fortune after reportedly starting with just $210 and found early success by aping into Pepe while its market cap was still under $1 million. He now says he will come back and make the “trade of the century” to earn him a billion dollars this time.

Farcaster receives first-ever Solana airdrop, four more on the way

The first-ever airdrop from a Solana-based project on Farcaster has taken place, with users receiving 6,500 CRCS, the native token for Circus — itself an app for launching tokens on X and Farcaster.

According to Bountycaster founder Linda Xie, the airdrop was completed using ZK compression, which made it a less expensive endeavor to carry out than it would typically be. She added that there are four more Solana airdrops on the way, totaling $80,000 in value.

By the numbers…