Hyperstition #24 — June 3, 2025

Pump.fun reportedly plans $1B token sale, Wynn reloads $100M BTC bet, and more.

Pump.fun reportedly plans $1B token sale: Blockworks

Memecoin launchpad Pump.fun is reportedly preparing to raise $1 billion through a token sale at a $4 billion fully diluted valuation (FDV), according to sources cited by Blockworks. The sale will target both public and private investors, though a timeline for launch has not been confirmed, Blockworks said. Pump.fun has reportedly generated over $700 million in revenue and helped mint nearly 11 million tokens. The rumored raise would cement its status as a top crypto unicorn.

In Other News…

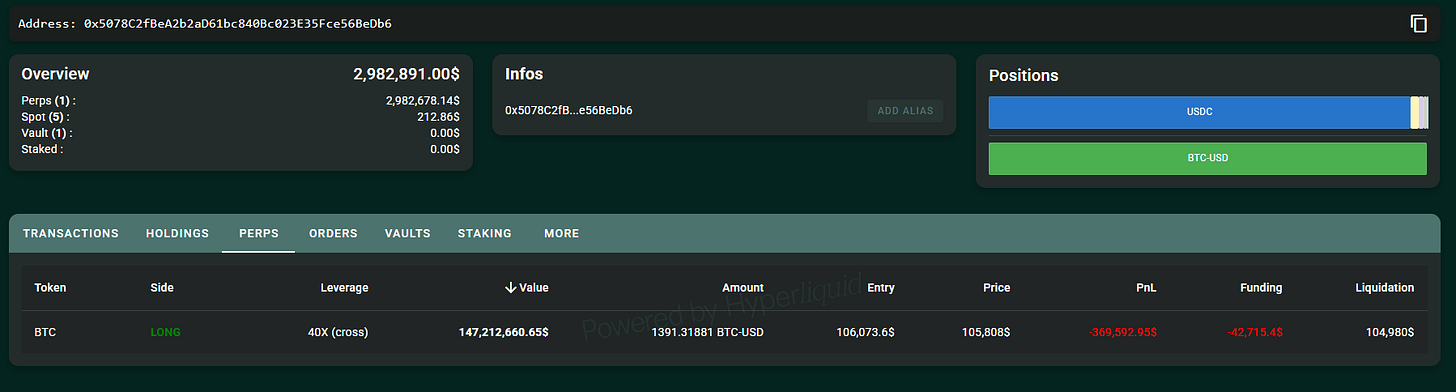

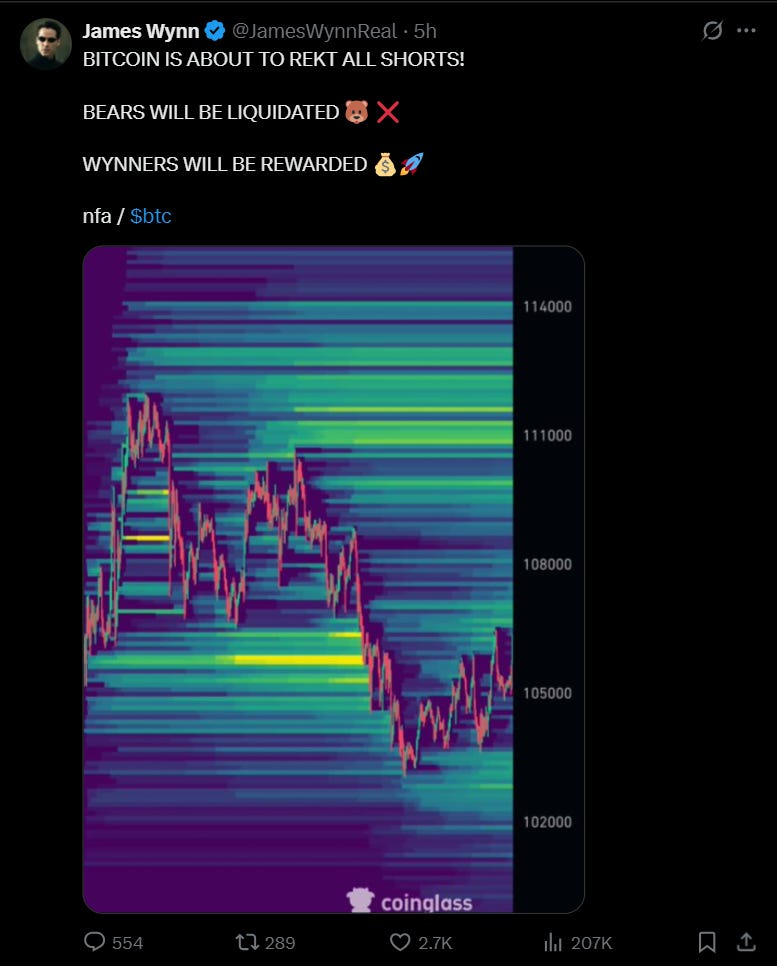

James Wynn reloads $100M Bitcoin long after prior liquidation

Cryptocurrency trader James Wynn has opened another leveraged long position on Bitcoin nominally worth more than $100 million less than a week after a similar bet was liquidated.

According to blockchain data from Hypurrscan, the new position will be liquidated if Bitcoin falls below $104,980.

Wynn’s previous $100 million position was closed out on May 30 after Bitcoin briefly dipped below $105,000.

The new trade comes ahead of the June 5 US jobless claims report, with markets showing signs of caution and support levels near $103,000. Wynn said he expects Bitcoin to rebound sharply soon.

Robinhood buys Bitstamp for $200M in global expansion bid

Online brokerage Robinhood has finalized its $200 million buyout of Bitstamp, a cryptocurrency exchange.

The deal grants Robinhood over 50 new regulatory licenses and immediate access to Bitstamp’s large institutional base across Europe, the UK, and Asia.

Bitstamp reportedly brings with it $95 million in trailing 12-month revenue and a clientele of over 5,000 institutions. Robinhood said Bitstamp is already integrated into its backend infrastructure.

This marks Robinhood’s second major crypto buy in less than a month, following a $179 million agreement to acquire Canadian platform WonderFi in May.

Hyperliquid co-founder defends transparent trading model

Hyperliquid co-founder Jeff has published a detailed defense of the perpetual futures exchange’s transparent trading model in a bid to address concerns about execution quality for large traders.

In a series of posts, he argued that transparency improves execution by enabling market makers to better price and size liquidity around large orders.

Citing parallels with large exchange-traded funds (ETFs) that rebalance in public auctions, Jeff argued that transparent systems like Hyperliquid can outperform private venues.

The exchange’s order book publishes all non-identity-sensitive data onchain, allowing counterparties to distinguish between toxic and non-toxic flow.

Binance.US to add Hyperliquid’s HYPE token

Binance.US is preparing to list HYPE, the native token of perpetuals exchange Hyperliquid. It said spot trading will go live soon, expanding access for US users eager to join the Hyperliquid ecosystem. The listing signals growing exchange support for Hyperliquid’s onchain-first model as it continues to gain traction with traders across the decentralized derivatives landscape.

By the Numbers…