Hyperstition #31 — June 12, 2025

Rethinking DeFi lending for Internet Capital Markets.

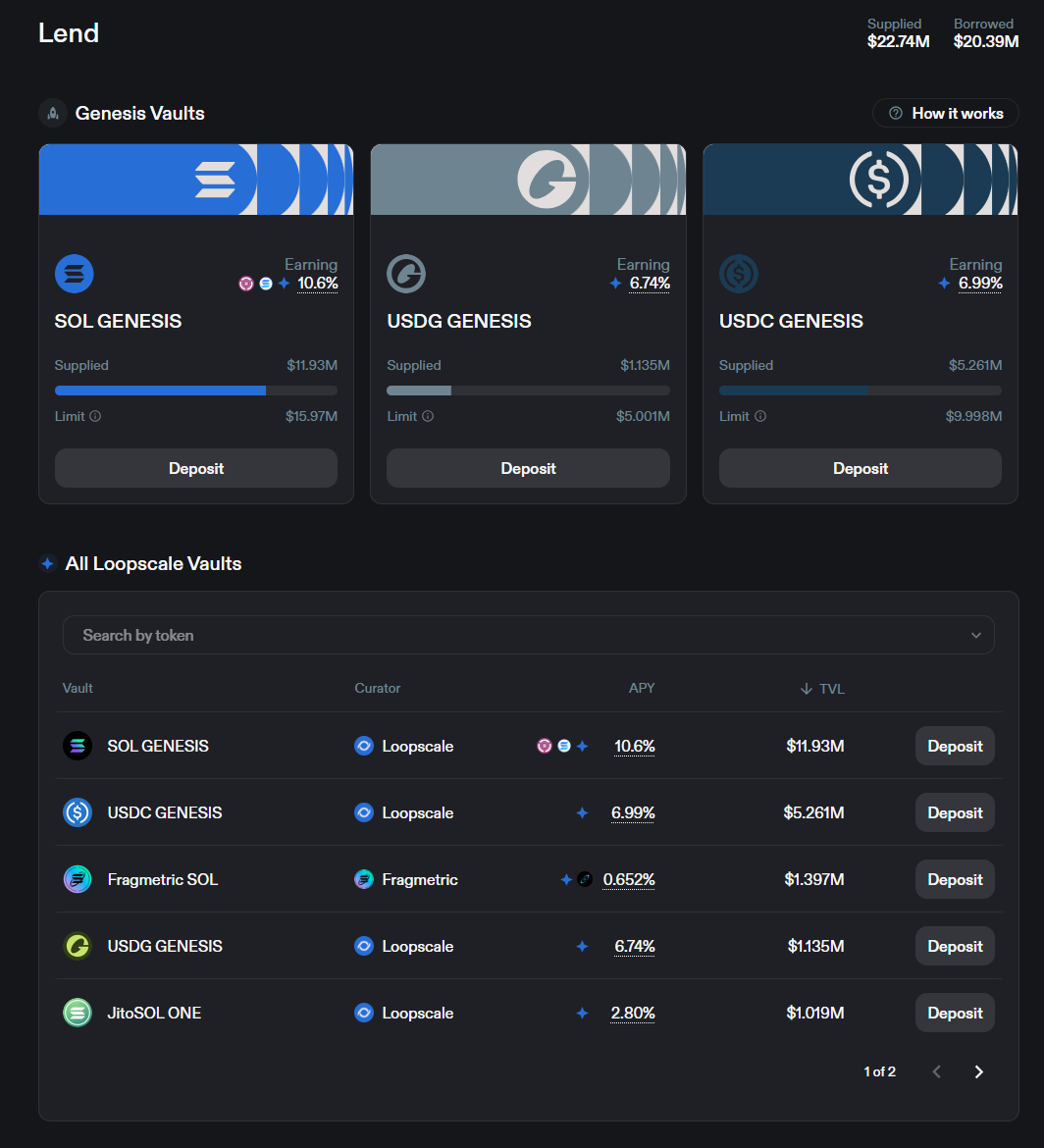

Why ‘good enough’ DeFi lending won't build Internet Capital Markets (Sponsored)

This post was authored by Loopscale.

Decentralized finance (DeFi) has become complacent with pool-based lending infrastructure. It's battle-tested and (usually) predictable, yes. But this legacy architecture can't deliver the sophisticated financial markets that Internet Capital Markets deserve.

In pool-based lending, borrowers pay interest that gets distributed across all deposited capital—including funds sitting idle. This creates an inherent spread: borrowers might pay 10% while lenders earn only 7%. That 3% gap represents capital inefficiency that institutional finance would never tolerate.

Pool models made sense when Ethereum forced constraints and crypto lending was unproven. But we're still using those same designs even as we build financial infrastructure for Internet Capital Markets. It's time to move beyond 2020's limitations.

Beyond "Good Enough": Modular, order book-based lending

Lending markets need to price risk correctly. They must support any asset with willing counterparties. They shouldn’t dilute returns with idle liquidity or price volatile collateral the same as stable assets.

Order book lending delivers for these requirements — and at scale. Solana's transaction throughput and sub-penny costs make sophisticated order book-based money markets viable for the first time in crypto.

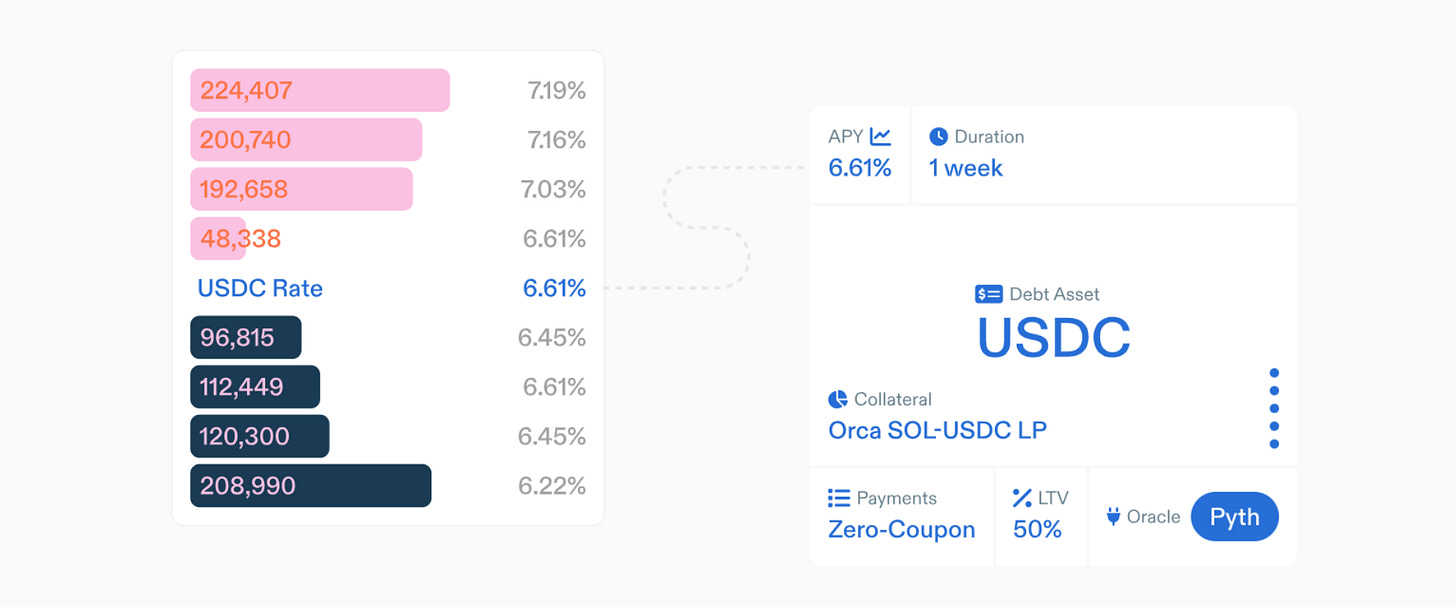

On Loopscale, the lend rate equals borrow rate. Markets form around any asset with willing counterparties—no governance votes, no minimum liquidity requirements. Risk gets priced per-collateral rather than per-pool.

This approach delivers consistently better rates than pool alternatives. Eliminating architectural waste means more capital actively earns yield.

The transition

Internet Capital Markets require infrastructure that matches traditional finance's sophistication while delivering crypto's permissionless access. That means isolated risk instead of systemic exposure. Market-driven rates instead of algorithmic curves. Support for any digital asset instead of governance-gated inclusion.

Pool-based lending was DeFi's training wheels. Loopscale, built on Solana, lets us remove them.

Loopscale is building Internet Credit Markets on Solana with order book-based lending, fixed rates, and support for any digital asset. Learn more at loopscale.com.

By The Numbers…