Hyperstition #5 — May 7, 2025

Has Bitcoin decoupled from stocks? Plus, India strike rattles prediction markets, CFTC drops Kalshi appeal, and more.

Has Bitcoin decoupled from stocks?

This is a guest post by Moonraker.

The early days of April 2025 featured a striking decoupling between Bitcoin and stocks. It lent credence to the view that digital asset values will increase as volatility and government intervention rattle traditional equity and debt markets.

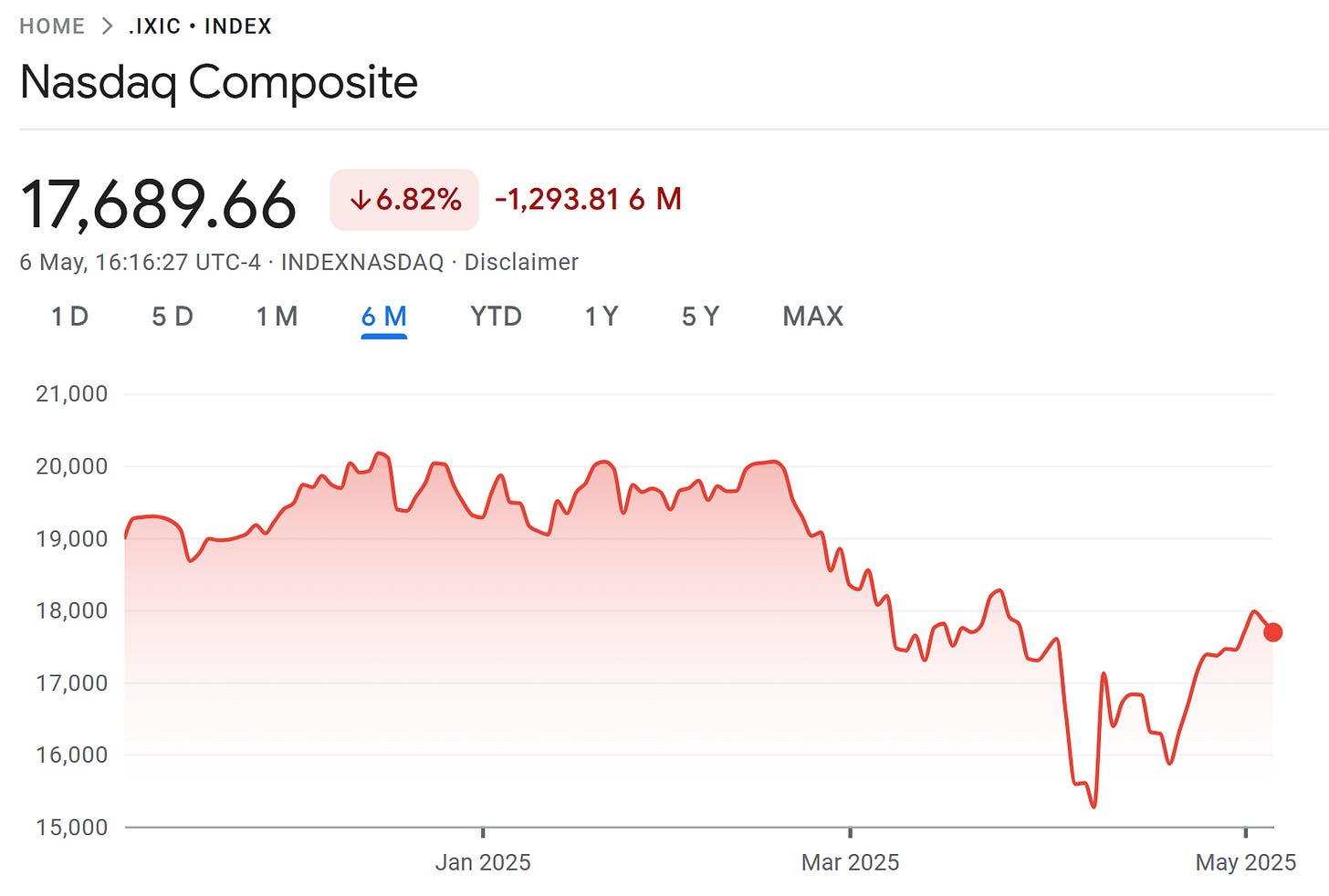

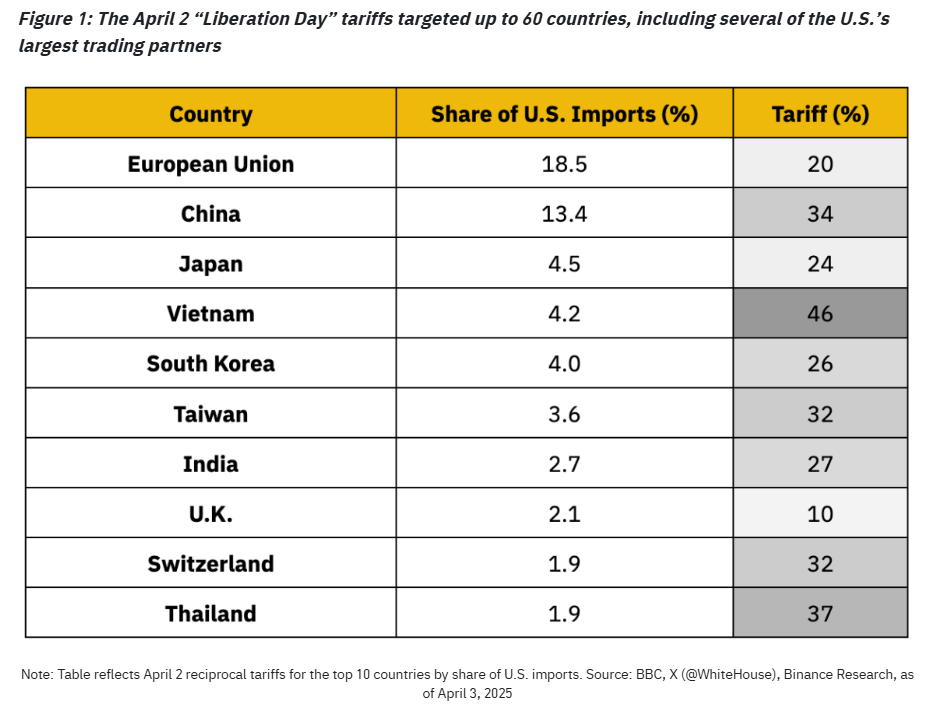

Starting on April 3, U.S. equity markets lurched downward in response to heightened trade tensions. The tech-heavy Nasdaq Composite plunged by roughly 11% over two sessions. The S&P 500 similarly fell sharply, briefly dipping into correction territory.

Yet Bitcoin’s price was remarkably stable — even rising about 1% on April 4, while stocks continued to sink.

By that Friday, Bitcoin hovered around $83,000 (down a modest 3–4% from the pre-tariff level), in stark contrast to equity indices that were down by double digits in percentage terms.

Challenging Assumptions

Market observers quickly noted this divergence. What had been a long-held assumption — that Bitcoin behaves as a high-beta version of tech stocks — was being challenged.

“Bitcoin has shown impressive resilience,” David Hernandez at 21Shares remarked to Coindesk on April 4, pointing out that BTC rebounded quickly after a brief dip, “reinforcing its status as a macro hedge in times of … stress.”

In other words, during that volatile first week of April, Bitcoin began trading less like a speculative “risk-on” asset and more like a defensive one.

By early May, BTC finished up by double digits (around +12–13%), far outpacing the flat-to-negative performance of the S&P 500 and Nasdaq.

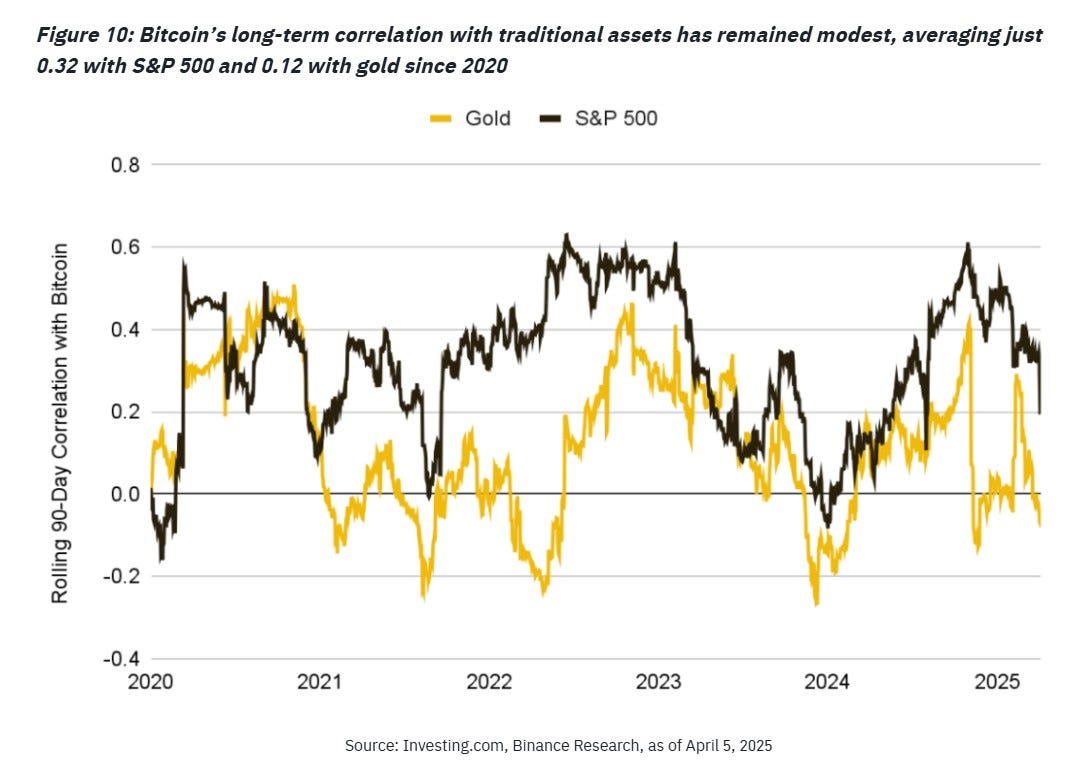

Its correlation with stocks has weakened — some measures show a multi-year low (~0.3) — but it hasn’t vanished entirely (30-day correlation ~0.6 as of late April).

Trading like ‘Digital Gold’

BTC’s resilience amid stock volatility suggests investors treated it more like the “digital gold” maxis have long expected.

As trade-war and recession fears spiked, money rotated into classic havens (gold hit a record ~$3,500, +6% in April) and ultimately into BTC as an inflation and crisis hedge. This reflects shifting sentiment toward Bitcoin as a legitimate store of value in times of macro uncertainty.

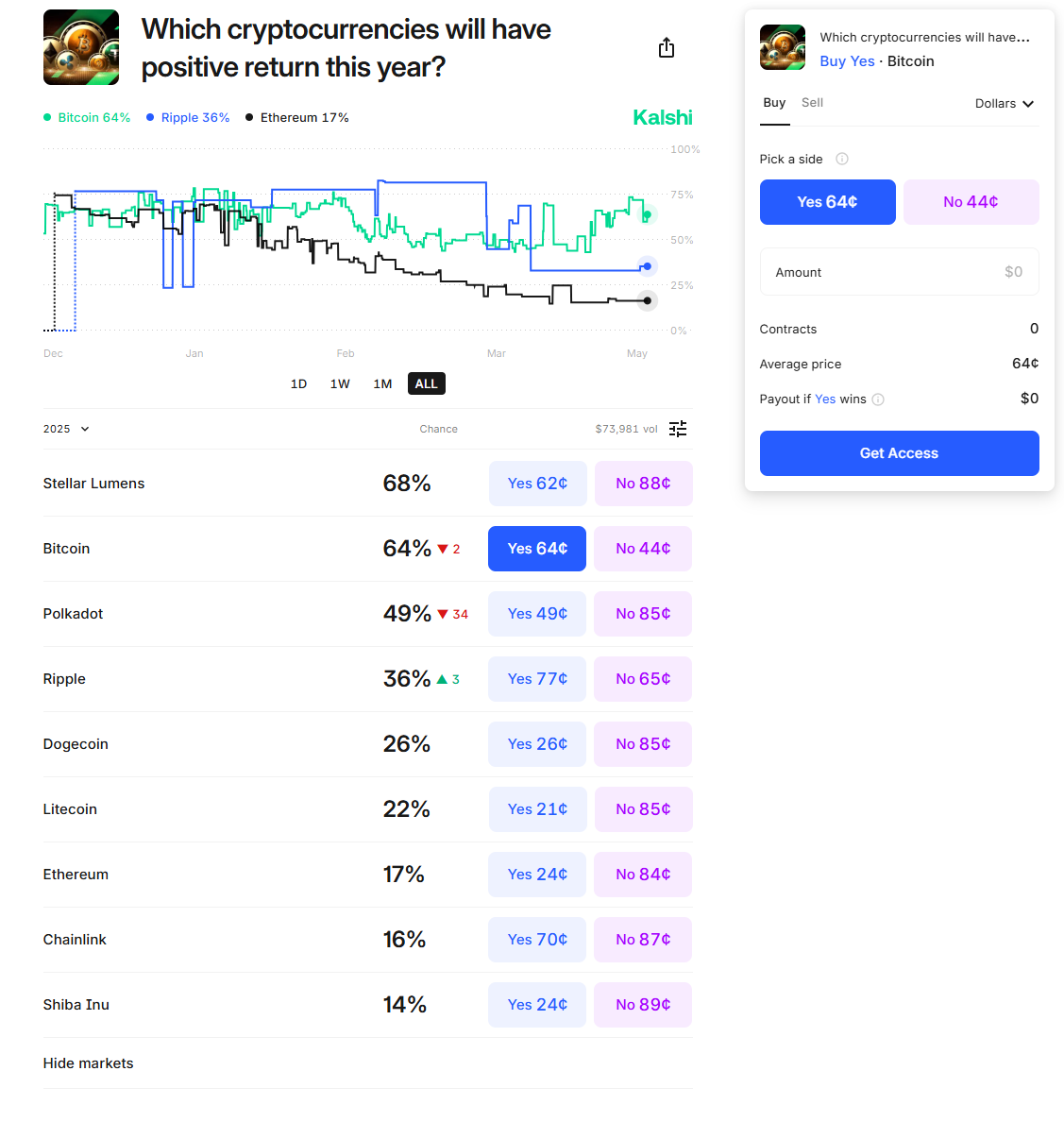

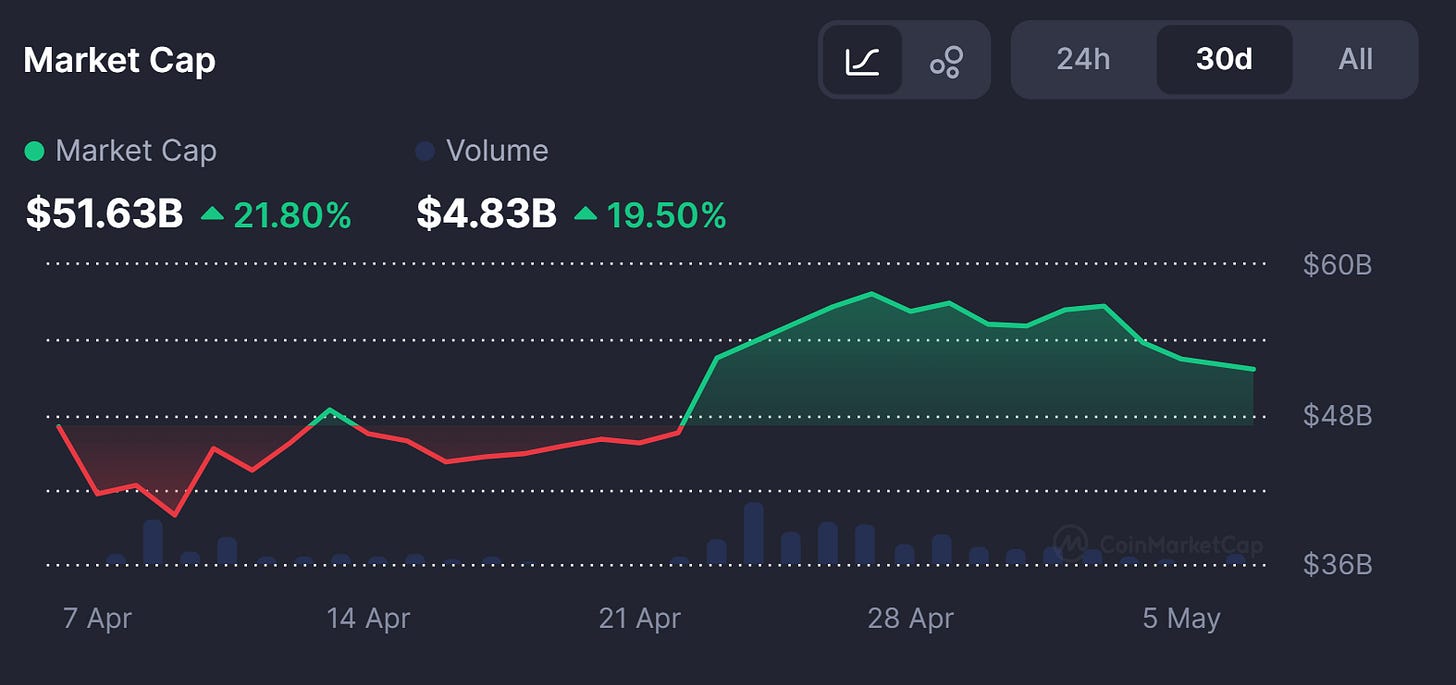

But not all digital assets are treated by the market as a store of value and a haven from volatility. Large-cap cryptos like Bitcoin (and to a degree, Ethereum) led the rally and decoupling narrative, whereas speculative altcoins (memecoins, Solana, etc.) remained driven by risk appetite.

For example, Solana’s memecoin ecosystem actually expanded by about 9% in market cap in April’s latter weeks — a surge fueled by speculative fervor (tokens like “BONK” and a Trump-themed coin) rather than safe-haven demand.

This suggests Bitcoin/Ethereum are behaving more like value stores, while smaller coins still trade like high-risk assets.

In Other News…

India strike in Pakistan rattles prediction markets

On May 6, India reportedly conducted a military strike against neighbor Pakistan, further escalating tensions between the longstanding adversaries. Bettors on Polymarket had previously assigned a less than 40% chance of a strike before June. (The odds are now set at 100%). As of May 6, Polymarket bettors are forecasting a 23% chance India invades Pakistan before July. They are pegging the odds that Pakistan retaliates by Friday with an air or missile strike against India at 73%.

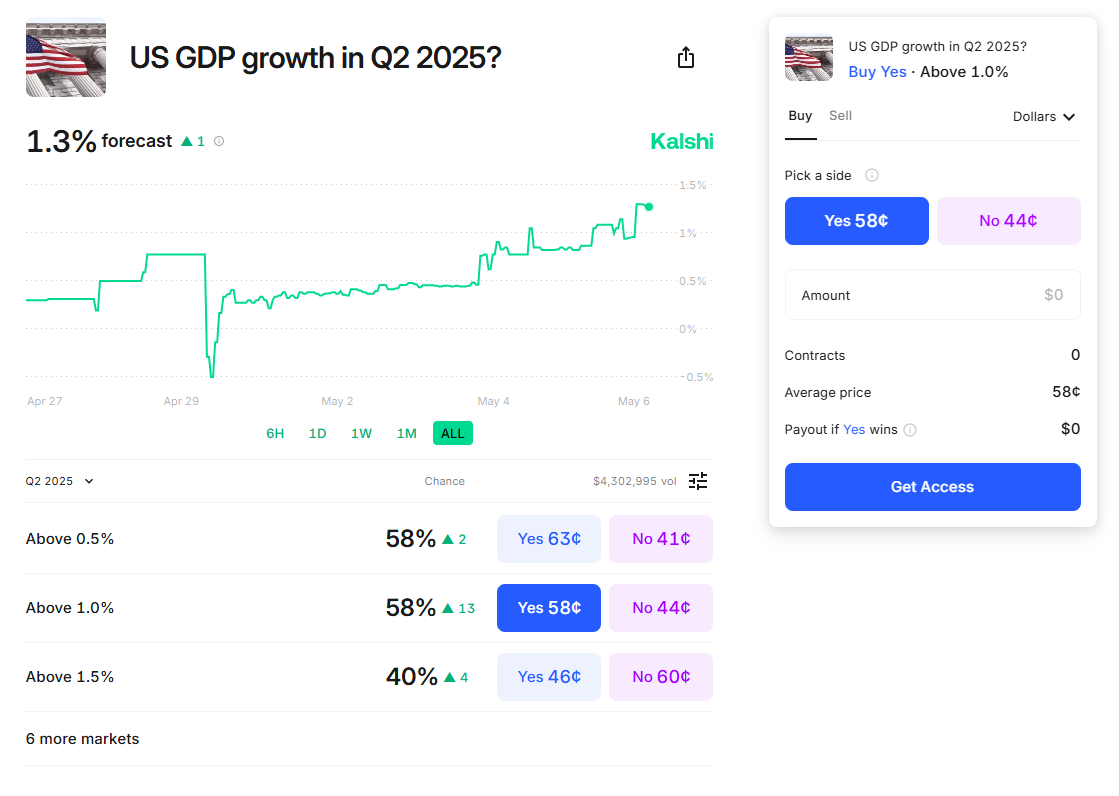

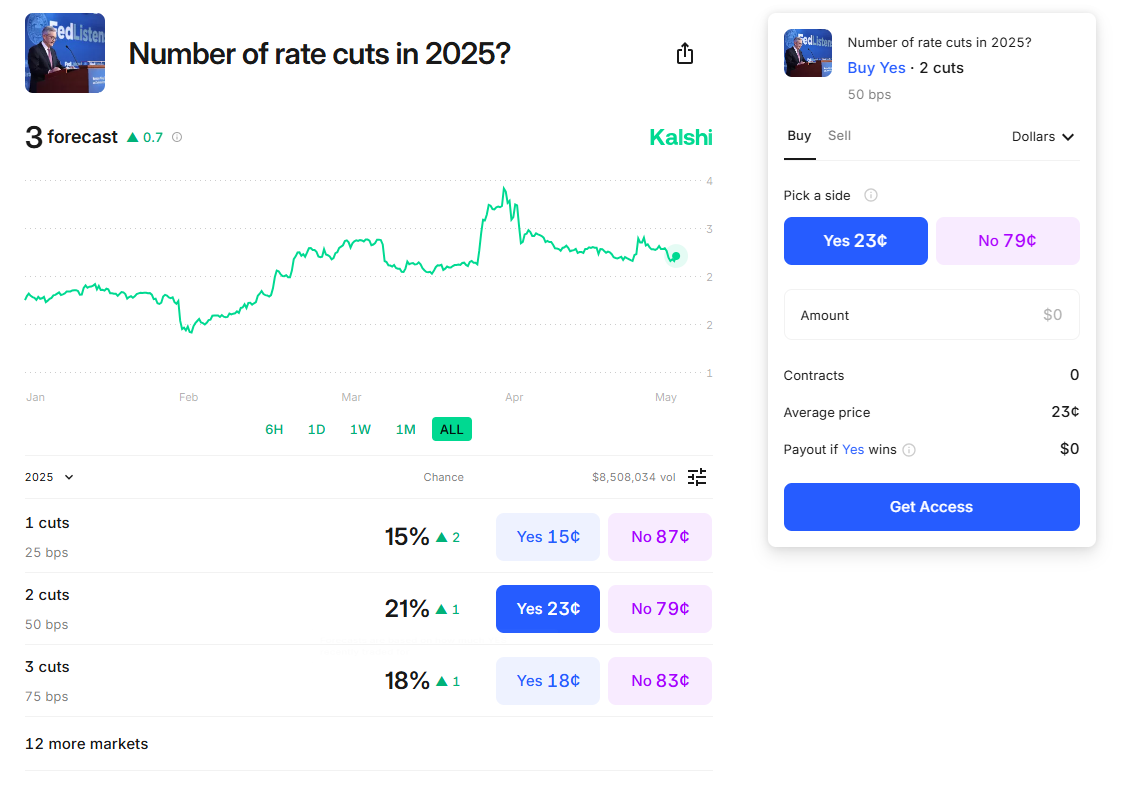

CFTC seeks dismissal of Kalshi appeal

The Commodity Futures Trading Commission (CFTC), the US’s top derivatives regulator, has asked a federal court to dismiss its appeal of a 2024 ruling permitting election betting in the US. The CFTC’s motion to drop the appeal, which was brought under the prior administration, signals an end to US federal efforts to quash election betting markets.

Loopscale to re-enable vault withdrawals in ‘next few days’

On May 6, Loopscale said the Solana lending protocol will re-enable vault withdrawals within “the next few days.” The move comes after Loopscale recovered approximately $5.8 million in USDC and SOL stolen in an April 26 exploit. The DeFi protocol has already reopened other lending markets.