Welcome to Hyperstition

Decrypting Internet Capital Markets

Welcome to Hyperstition — the first media platform dedicated exclusively to Web3’s Internet Capital Markets.

Every weekday, we deliver original reporting and analysis on the most important developments across memecoins, prediction markets and more.

We also host a daily livestream on our X account, @HyperstitionHQ, at 9:30 a.m. EST/1:30 p.m. UTC. (Tune in Thursdays for AMAs with the space’s top builders!)

Why Internet Capital Markets?

Hyperstition is founded on the belief that Internet Capital Markets — permissionless marketplaces for tokenized assets — are the future of the global financial system.

Cryptocurrencies already command nearly $3 trillion in market capitalization. That figure is set to rise dramatically by 2030 as upwards of $30 trillion worth of assets migrate on-chain.

But that’s only half the story. Not only is tokenization improving the efficiency of traditional financial markets. Its also giving rise to entirely new types of assets.

As Multicoin Capital puts it:

“blockchains have laid bare the reality that all units of value—currencies, commodities, equities, derivatives positions, debt obligations, memecoins, governance tokens, utility tokens, NFTs, and more—can be represented as standardized tokens on a permissionless blockchain.”

This is where Hyperstition comes in. We are chronicling the evolution of Web3’s native asset markets — the most disruptive of which are markets for attention itself.

Beyond Memecoins

The rise of Pump.fun was arguably 2024’s defining meta.

Since January of last year, the Solana memecoin launchpad has deployed more than 10 million tokens, collectively worth upwards of $4 billion, according to Dune Analytics.

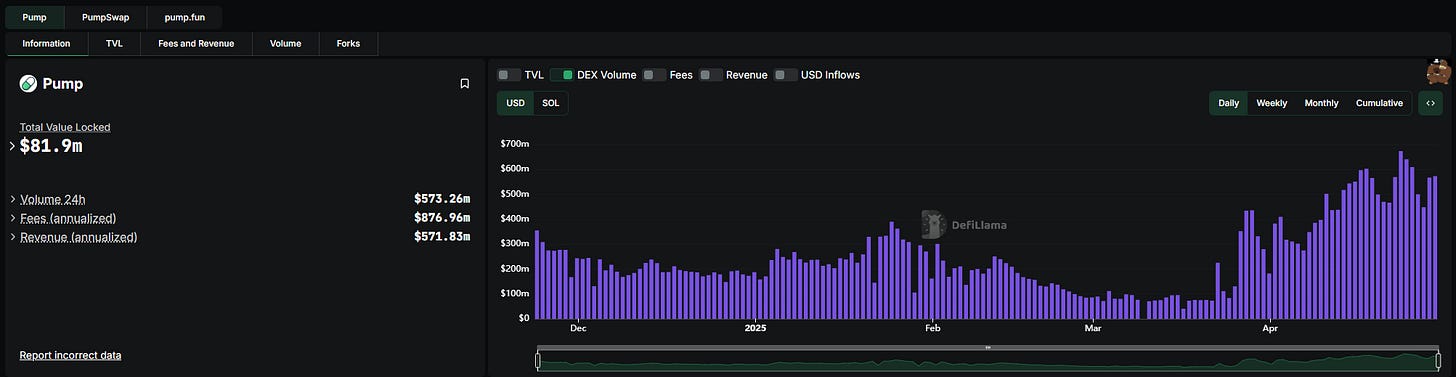

In December, Pump.fun generated more than $6 billion in monthly trading volume and earned fee revenues exceeding $5 million per day, according to DeFiLlama.

That all changed in February, when a series of high-profile memecoin rugs — exemplified by the multi-billion Dollar flameout of the LIBRA token — reportedly sent activity on Pump.fun tumbling some 80%.

Upstart Launchpads

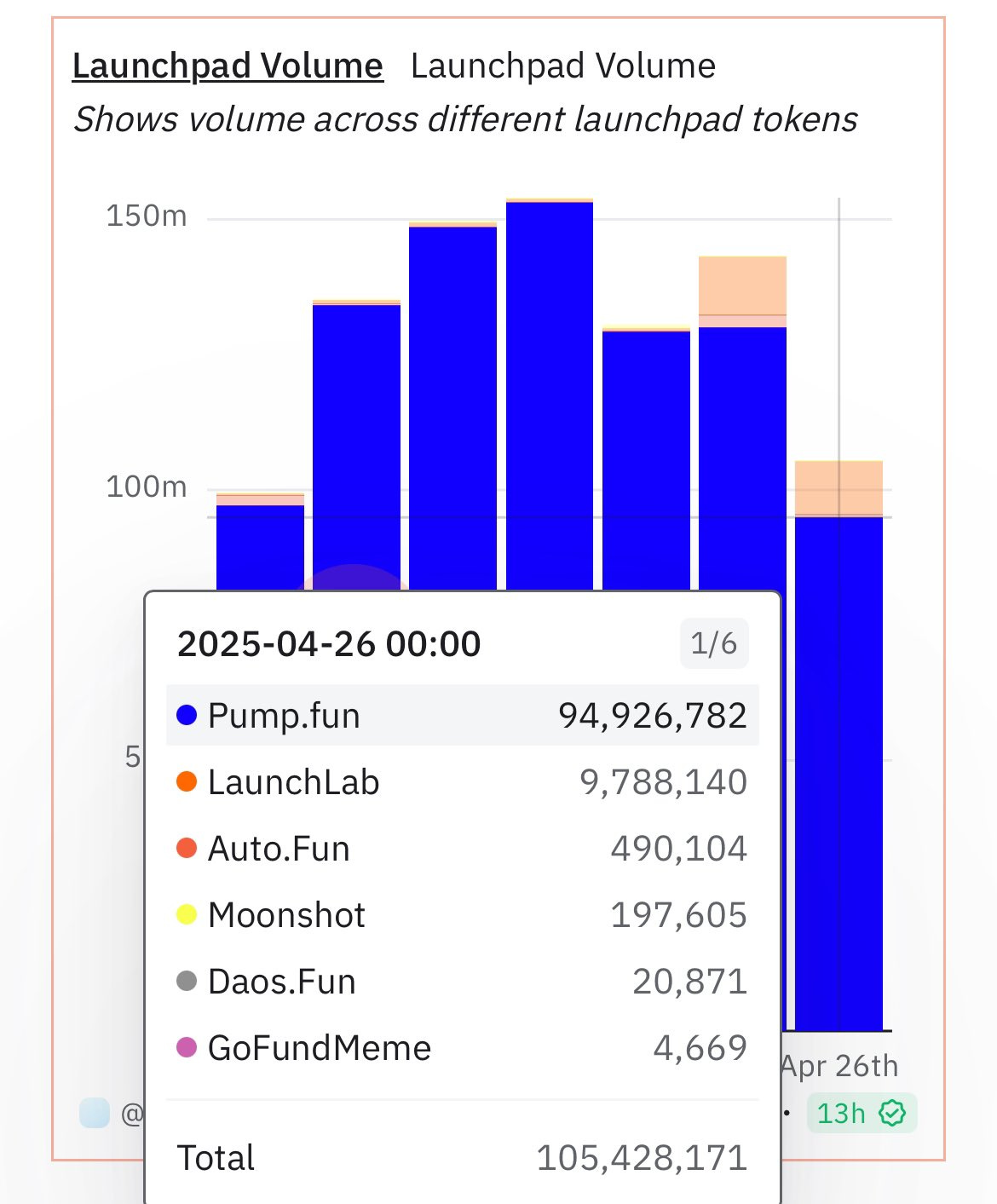

Conventional wisdom said memecoins were dead. Nothing could have been further from the truth. Instead, the ecosystem has matured at an unprecedented pace.

In March, Pump.fun launched decentralized exchange (DEX) PumpSwap, ending its longstanding partnership with Raydium, Solana’s most popular DEX. Raydium, in turn, rolled out LaunchLab, a Pump.fun competitor, in April.

Its been joined by menagerie of other upstart launchpads, including Auto.fun, Daos.fun, GoFundMeme, and LetsBonk.fun, among others.

Maturing Markets

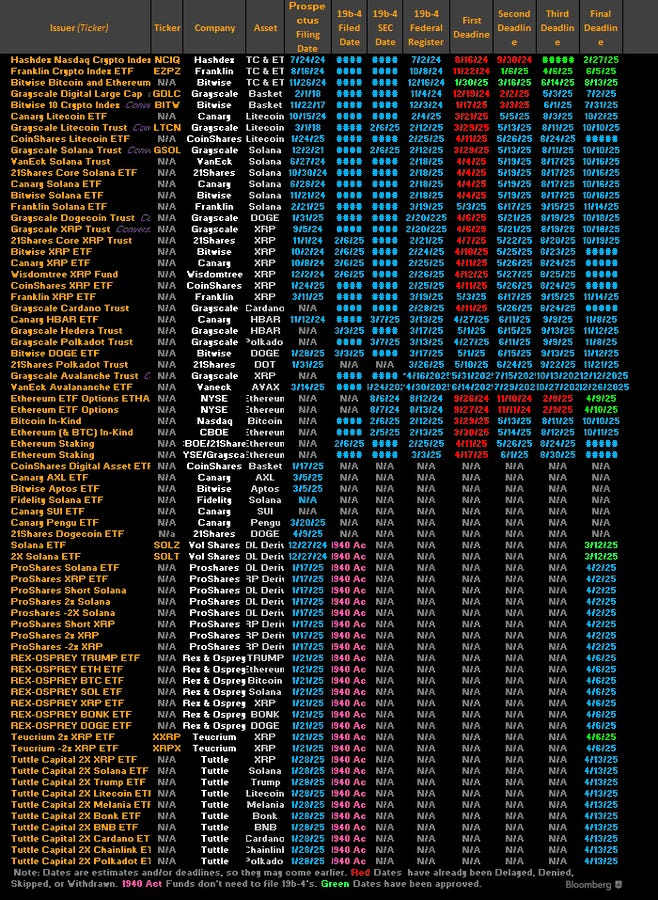

Meanwhile, new financial instruments — from exchange-traded funds (ETFs) to perpetual futures contracts — are extending memecoin trading far beyond spot markets.

Centralized exchanges, such as Coinbase Derivatives, are listing regulated futures contracts for blue-chip memecoins. Asset managers — including Grayscale, Bitwise, and 21Shares — are readying US memecoin ETFs.

Decentralized finance (DeFi) protocols — such as Hyperliquid and Hibachi — are spinning up perpetual futures markets for nascent runners. Loopscale, a Solana lending protocol, supports leveraged looping strategies for practically any token.

Collectively, these products are drawing new sources of capital into the ecosystem. They are also unlocking more sophisticated trading strategies, and ultimately stabilizing memecoin markets.

Predicting the Future

Memecoins aren’t the only way traders are betting on narratives. Prediction markets are also tapping into the news cycle — and increasingly defining it.

Exemplified by platforms such as Polymarket and Kalshi, prediction markets let traders wager on future outcomes using derivatives known as event contracts.

They rose to prominence in November, when event contracts accurately predicted US President Donald Trump’s election win long before the mainstream press. The projections reflected some $4 billion in trading volume.

Since then, prediction markets have (correctly) forecast hundreds of other real-world outcomes. The results are sometimes unsettling.

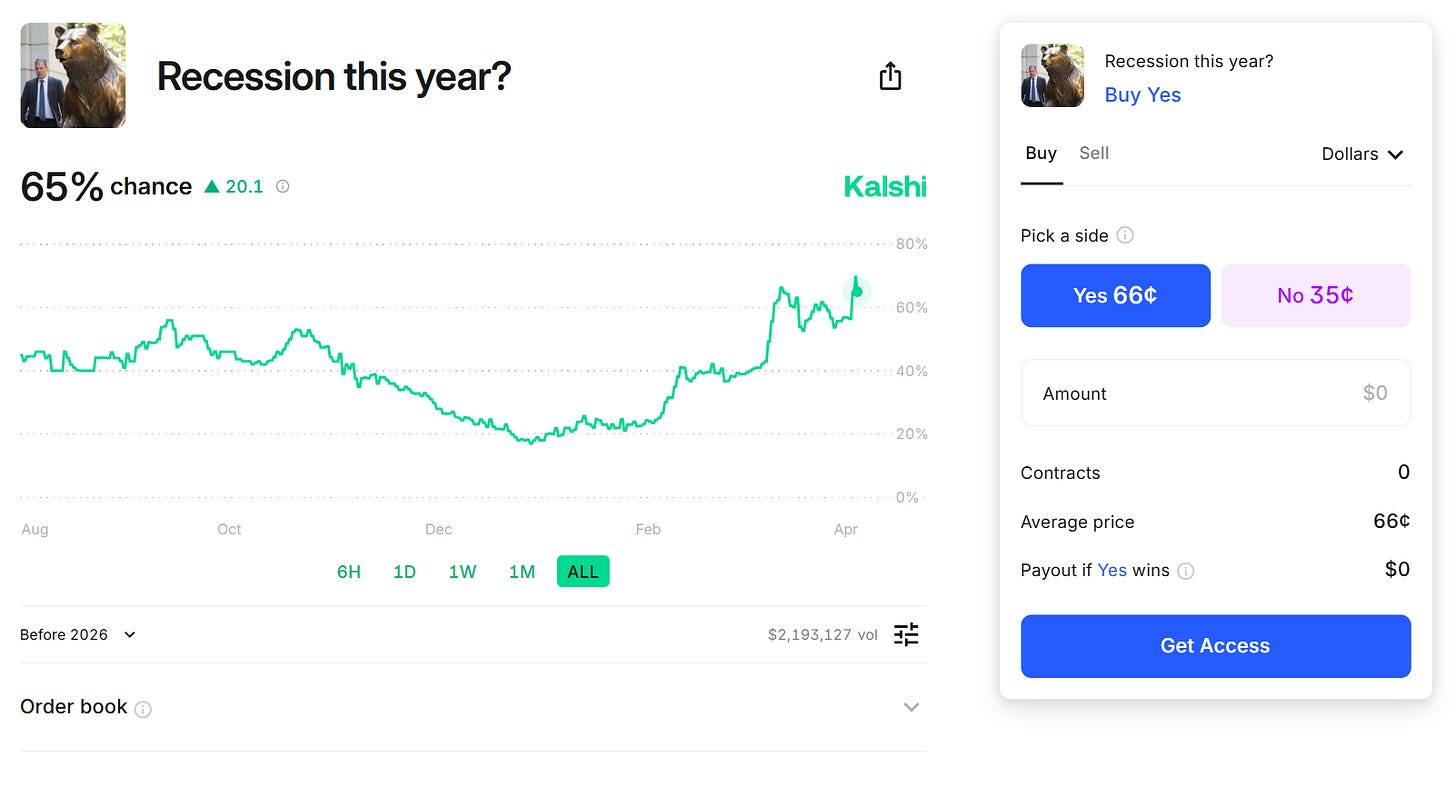

On April 29, both Polymarket and Kalshi surmised that the US was on the cusp of reporting its first quarterly economic contraction since 2022. The next day, officials reported a -0.3% decline in US GDP for the first quarter of 2025.

Now, Kalshi is forecasting a ~65% chance of the US entering a recession this year.

It’s not all bad news. Bettors on Kalshi expect Ether — the Ethereum network’s beleaguered native token — to rise to around $2700 per coin in 2025, a roughly 50% bump from its current price. They set the odds of a recovery past $4000 at more than 27%.

Looking Ahead

Memecoins and prediction markets are just the beginning. Internet Capital Markets are constantly evolving, giving rise to an endless procession of new asset classes.

It’s the dawn of a new era — and Hyperstition will be there every step of the way.

(Credit to @mynt_josh for the embedded videos!)