Hyperstition #17 — May 23, 2025

LIVE from Accelerate 2025: Solana is all-in on ICM. Plus, Hyperliquid weighs in on CFTC trading rules, and more.

Solana’s all-in bet on Internet Capital Markets

Solana has gone all-in on Internet Capital Markets.

If that wasn’t clear already, it certainly is after Solana’s flagship Accelerate 2025 event in New York City, which opened Thursday to a sold-out crowd of builders, investors, and press — including Hyperstition.

The event’s dominant theme: Internet Capital Markets (ICMs) are revolutionizing the financial system for the better, and Solana is all-in.

First described by venture firm Multicoin Capital in a January whitepaper, ICMs are global, permissionless marketplaces for tokenized assets — including memecoins and real-world assets (RWAs) as well as completely new asset types only possible on Web3.

“Today’s capital markets don’t work for everyone. Everyone feels this, even if they come to it from different angles,” Akshay BD, the Solana Foundation’s Chief Marketing Officer, said during Accelerate’s keynote speech, attended by Hyperstition.

“Crypto—and specifically Solana—is the only tech stack today that makes universal asset ownership possible,” he added.

Expanding across asset types

The Solana Foundation envisions ICMs expanding far beyond decentralized finance (DeFi) and memecoins, eventually “financializ[ing] [all] the productive assets of an economy so anyone participating in it can also own it,” according to BD.

“Solana is already enabling capital formation and token launches—but that’s just the beginning. Equity, credit, and yield-bearing assets come next,” he said.

The biggest potential impact of bringing these markets on-chain is opening them up to much smaller, earlier stage participants — even the local coffee shop.

“You should be able to walk into a coffee shop, scan a QR code, buy tokens, and get dividends from a business you believe in,” BD said.

They can also transform traditional financial markets, including the multitrillion-dollar market for US equities.

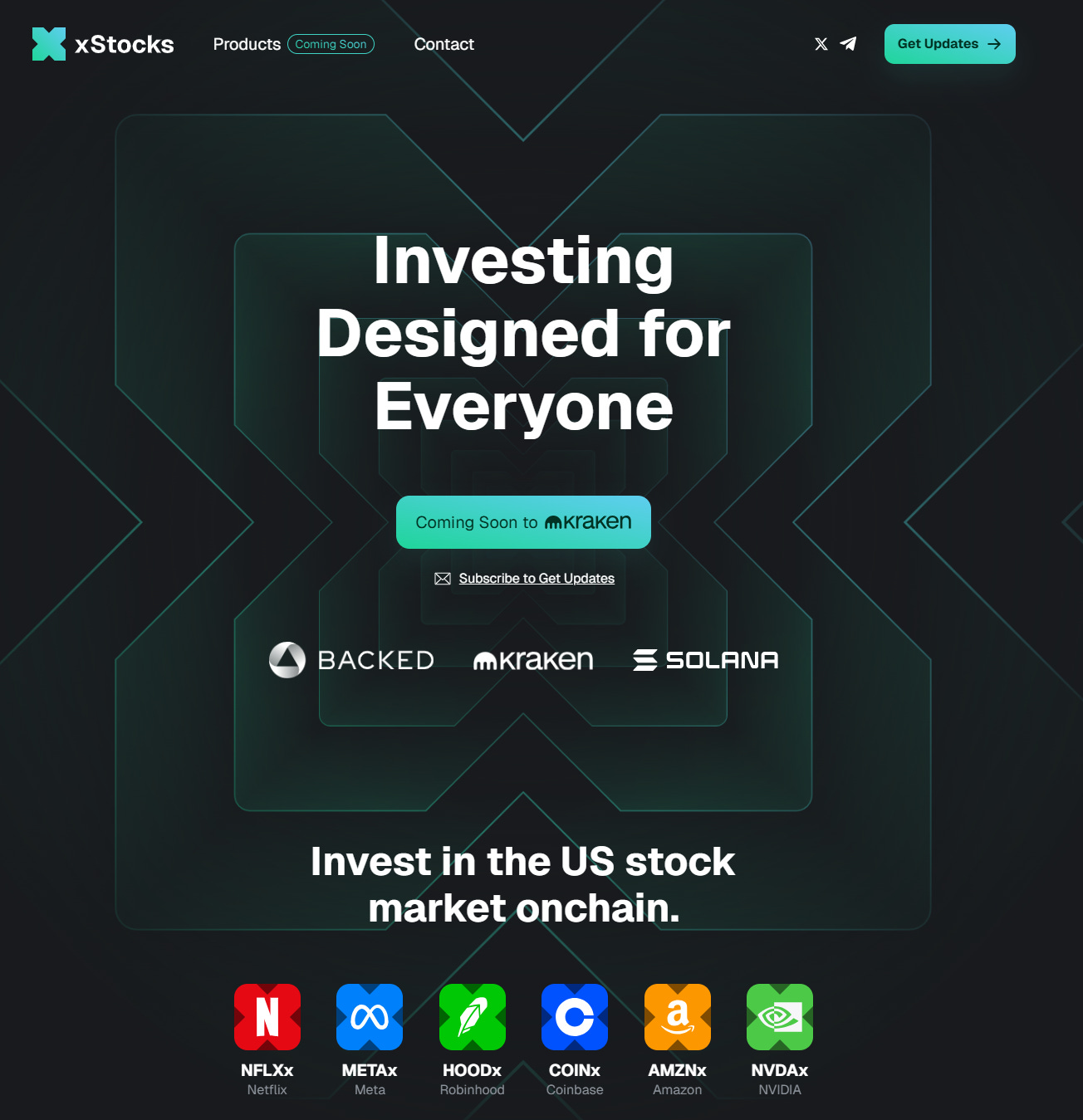

At the Accelerate 2025 event on Thursday, US crypto exchange Kraken announced the launch of xStocks — a suite of roughly 50 tokenized stocks and exchange-traded funds (ETFs) designed for on-chain trading and self custody.

“This time, the focus isn’t just on yield or speculation—it’s about building a new trust layer on top of what crypto already enables,” Arjun Sethi, Kraken’s CEO, said during the conference.

Tokenizing stocks enables 24/7 trading, as well as new strategies employing DeFi smart contracts.

“You should be able to take your collateral—whatever it is—anywhere, anytime, without permission,” Sethi said.

“If you want to use your tokenized equity or stablecoin as collateral for credit or loans, that should be seamless and borderless,” he added.

Enhancing financial freedom

ICMs not only enhance financial freedom. They also stand to make investing more accessible, potentially resolving worsening wealth inequality, BD said.

In 1931, the average investor had to work 25 hours to buy one share of the S&P 500, an index of top US stocks. They now must work 195 hours to afford the same unit of equity, according to BD.

“Your freedom is hyperinflated… You don’t get to buy the next Amazon at IPO anymore. That upside has already been captured in private rounds,” he said.

“It’s not Main Street vs. Wall Street—it’s giving Main Street access to the new Wall Street, which is on the internet.”

In other news…

Hyperliquid urges US regulators to embrace 24/7 trading

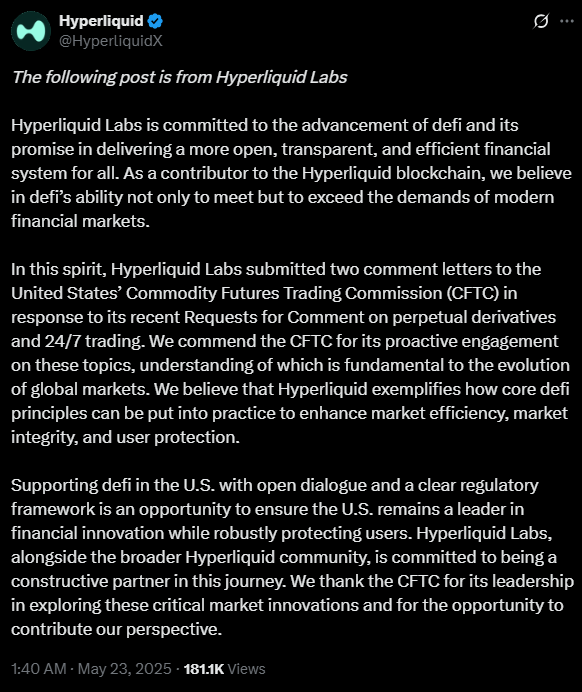

Hyperliquid has sent two comment letters to the US Commodity Futures Trading Commission (CFTC) addressing the agency’s inquiries into perpetual derivatives and 24/7 trading. The layer-1 blockchain network, which specializes in low-latency trading, sought to highlight how decentralized finance (DeFi) can improve market structure and user protections. The move comes as CFTC Commissioner Summer Mersinger signals that perpetual crypto futures may soon gain US regulatory approval for the first time.

By the Numbers…