Hyperstition #8 — May 12, 2025

Can traders arb prediction markets? Plus, Boop cancels airdrop, DOOD token sputters, and more.

Can traders arbitrage prediction markets?

This is a guest post by Moonraker.

Events around the 2024 U.S. presidential election highlighted an exciting opportunity in prediction markets: when identical outcomes are priced differently across sites like Kalshi, Polymarket, and PredictIt, traders can extract meaningful profit by arbitraging the spread.

For those who are sharp-eyed and fast with execution, the market disparities can offer seemingly easy returns, with some important caveats (one being that this is not in any way advice about how you should invest).

When Trump Was 49¢ and 56¢ at the Same Time

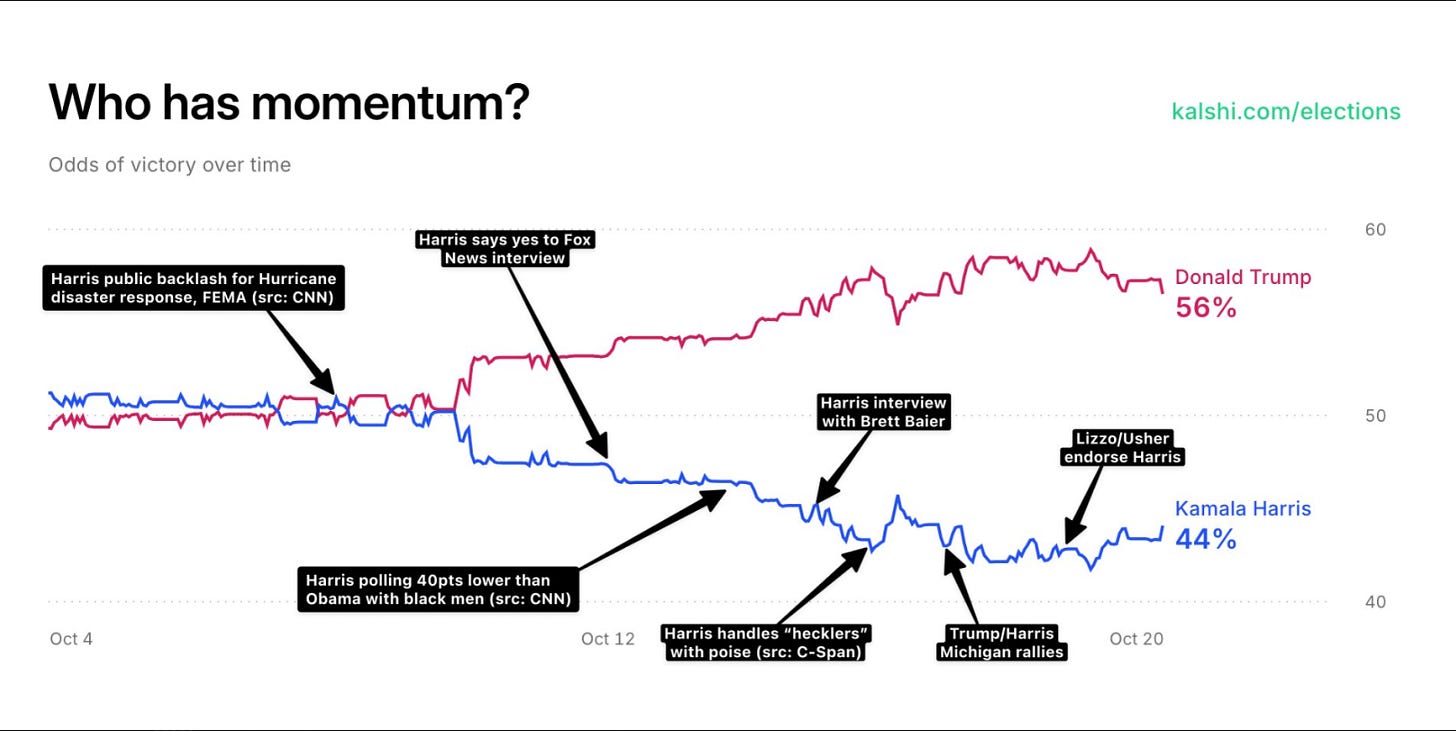

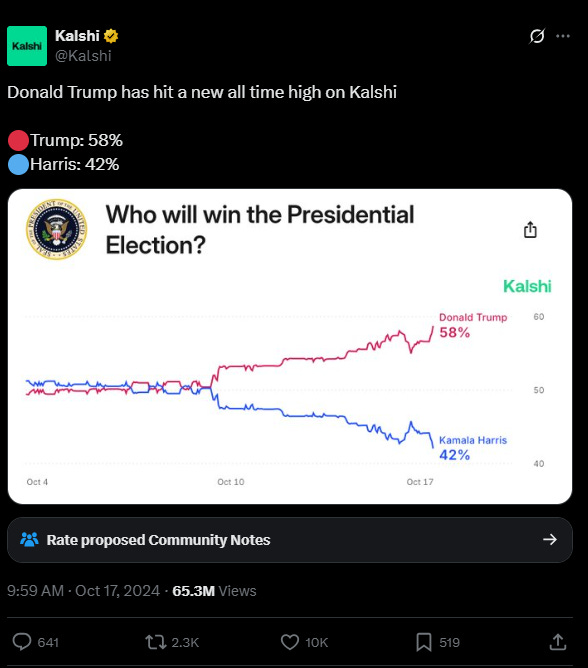

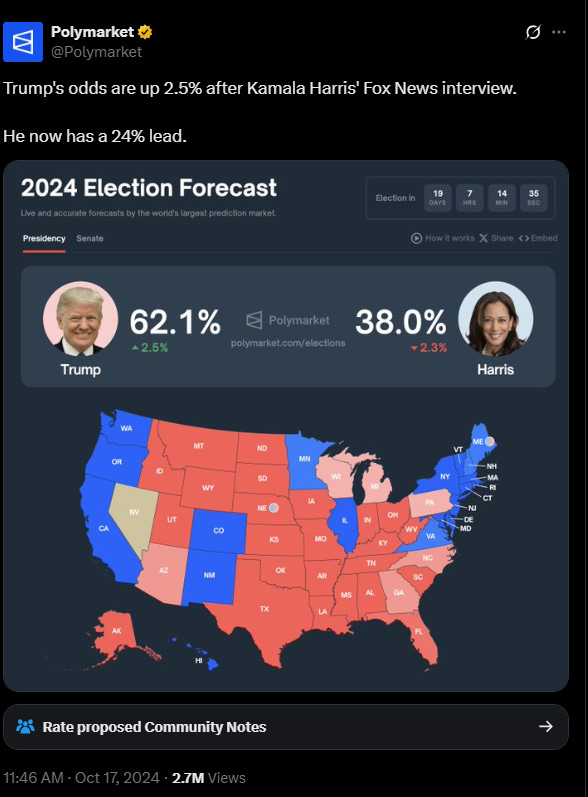

In October 2024, a delta emerged between Polymarket and Kalshi regarding the probability of Donald Trump winning the presidency. On Kalshi, “Trump to win” contracts hovered around 49¢, while on Polymarket, the same outcome traded closer to 56¢.

Traders on X and Substack were quick to flag the discrepancy. At one point, Harris “Yes” shares also traded lower on Polymarket than the aggregate of related bets on Kalshi, opening the door to multi-legged spreads.

This wasn’t a fluke. Polymarket had seen a wave of large, one-sided bets following public endorsement from figures like Elon Musk, which temporarily skewed its pricing away from more sober, poll-informed platforms like Kalshi.

For traders with accounts on both platforms and capital already deployed, this was a classic arbitrage setup.

The Mechanics: How to Arbitrage Prediction Markets

Let’s say you spot an opportunity where the same “Yes” outcome trades at 49¢ on Kalshi and 56¢ on Polymarket.

You buy “Yes” on Kalshi and the equivalent “No” on Polymarket. Your total outlay is $0.49 + $0.44 = $0.93.

No matter who wins the election, one leg pays $1 and the other expires worthless. That nets you 7¢ per share—a 7.5% return—locked in as long as both trades execute and the markets settle correctly.

This approach is most effective when both platforms offer deep liquidity and fast execution. Traders with custom-built dashboards and bots can even scan for these mismatches in real-time.

But even manually, the concept is straightforward and highly actionable. However, this type of trading is risky and not to be attempted without deep study beyond what I have outlined in this article.

The Window Doesn’t Stay Open

As with most market inefficiencies, these opportunities vanish fast.

Once the arbitrage becomes visible, it suffers alpha decay. Prices converge and fees, spreads, and slippage quickly eat into returns.

During the Trump/Harris spread, some traders reported that the profit window lasted only hours and sometimes just minutes.

The field is crowded. Smart money, bots, and even institutional players may be watching these platforms. By the time most traders recognize the mispricing, it’s often too late to execute profitably at scale.

Your best approach may be to focus narrowly on one type of prediction and add an arbitrage strategy to deploy if you happen to notice the opportunity arise in your specialty.

Where the Alpha Lives

The best prediction market arbitrage tends to show up in three scenarios:

Cross-platform divergence between markets with different user bases (e.g., crypto-native Polymarket vs. U.S.-regulated Kalshi).

Sudden sentiment shocks, such as viral tweets or media stories that impact one platform more than another.

Low-liquidity or long-tail markets, where a single whale or imbalanced order book temporarily distorts the price.

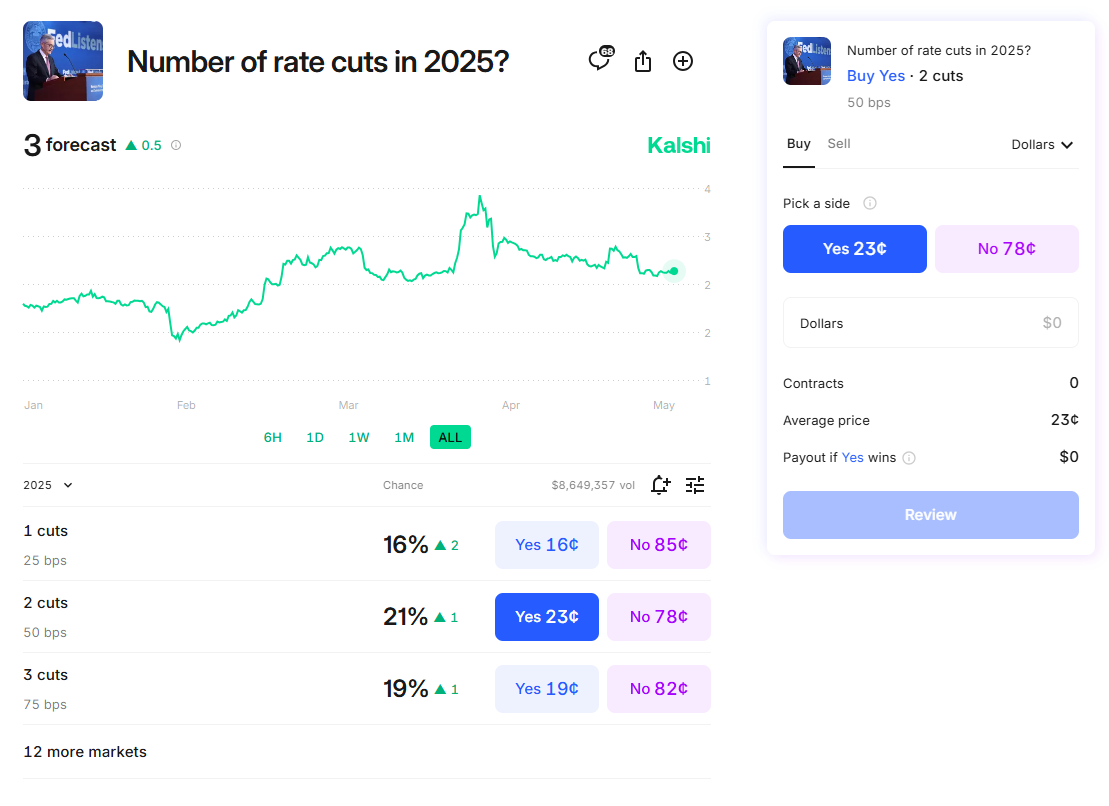

If you’re interested in getting after this alpha, focus on learning three strategy categories:

Long/Short Cross-Market Pairs: Buying an outcome on one platform and selling it on another.

Multi-outcome Spread Trades: Bundling outcomes across related contracts to lock in profit if the total cost is less than $1.

Resolution Risk Hedging: Scrutinizing how contracts define outcomes—sometimes the same-sounding market may resolve differently due to wording, which can kill an apparent arbitrage.

Alert, Alert: Proceed With Caution

While prediction market arbitrage is straightforward in concept, it’s not risk-free in execution.

Platform fees can quietly erode profits. Slippage can eat your edge before you complete both legs. Market quirks, like contract resolution differences (pay especially close attention to the conditions for how the prediction is resolved) or delayed settlements, can lead to asymmetric outcomes.

Worse, you might do everything right and still lose out because someone else moved faster or sized bigger.

Good luck out there, and remember that you should not try trading like this unless you are an expert and can afford to lose your capital!

In Other News…

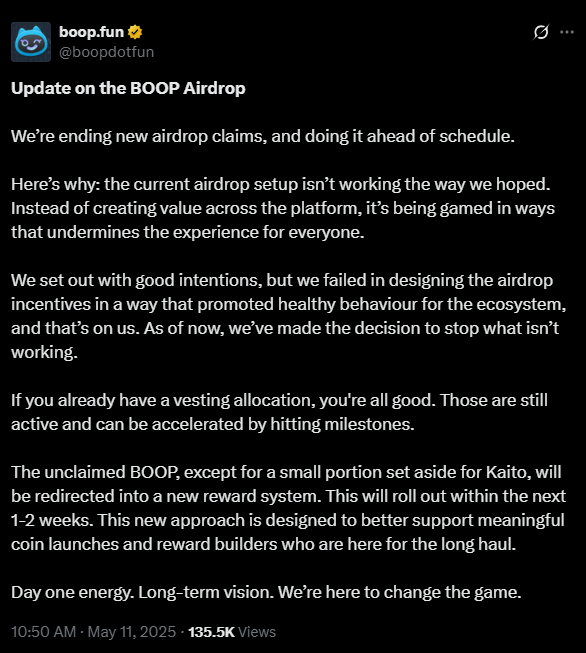

Boop calls off airdrop days after announcing overhaul

Boop has ended its controversial airdrop, the Solana memecoin launchpad said in a May 11 X post. Only days earlier, the project had tipped plans to overhaul the terms of its token distribution without canceling it altogether. However, the proposed overhaul drew sharp criticisms from influencers who had already launched tokens on Boop expecting large payouts of the project’s native BOOP token. In an X post, Boop’s creator dingaling said the project has a “much better designed incentive system coming out in 1-2 weeks,” adding that the project had “missed some clear loopholes in our airdrop incentive design.”

Doodles’ DOOD airdrop sputters on first trading day

On May 9, Ethereum-native non-fungible token (NFT) project Doodles’ announced the much-anticipated airdrop of its native DOOD token. After briefly tapping a market capitalization of $100 million, the token proceeded to trade down to below $50 million before stabilizing at approximately $60 million. The DOOD token’s performance disappointed community members, who had forecast a post-airdrop market capitalization in the hundreds of millions. (See Hyperstition’s May 8 issue for a DOOD valuation analysis.)

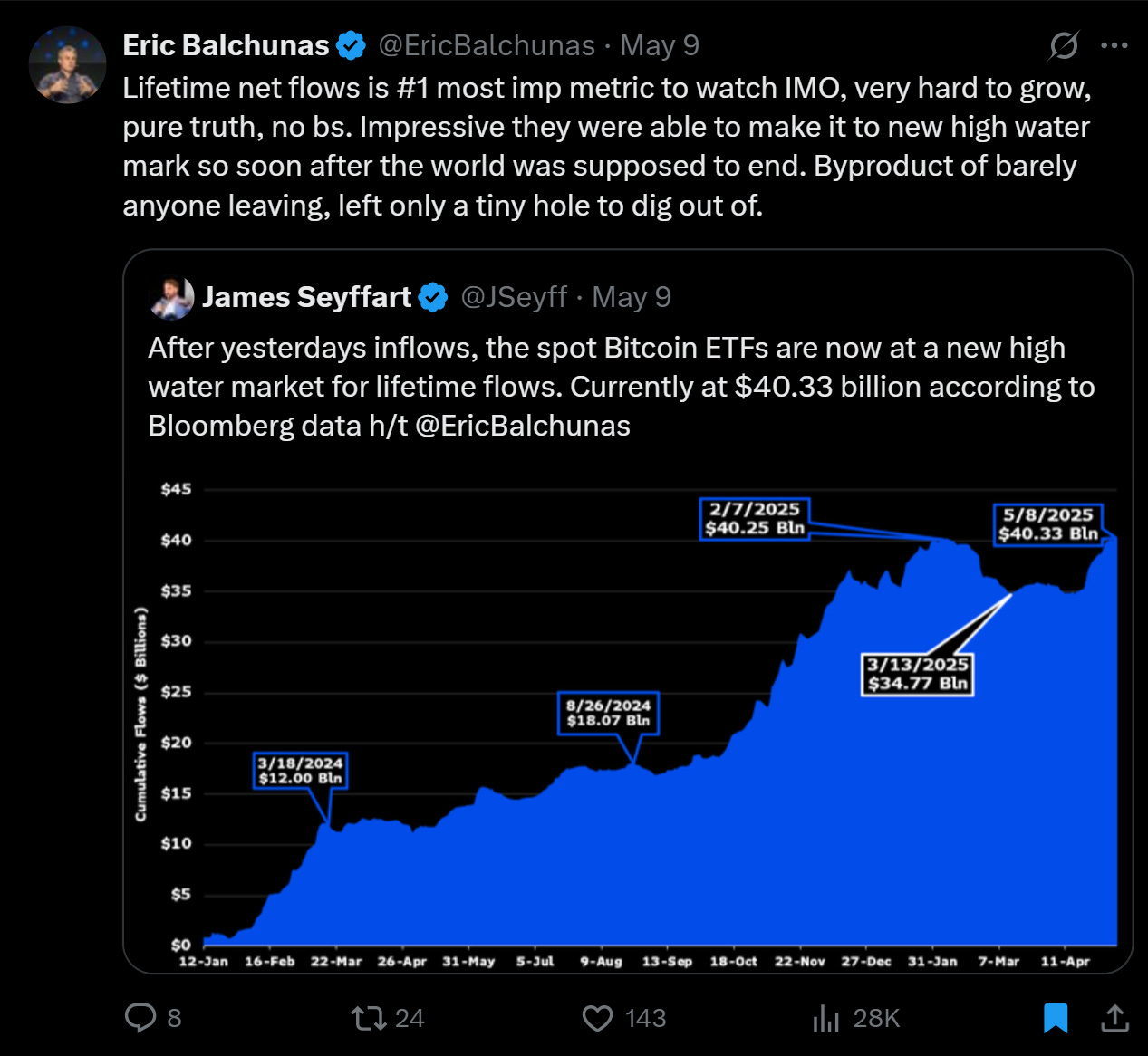

Bitcoin ETF net inflows hit all-time high

On May 9, cumulative net inflows into spot Bitcoin ETFs tapped $40.33 billion, surpassing a prior all-time high set in February, according to Bloomberg Intelligence. With upwards of 70 cryptocurrency ETFs — including altcoin funds — awaiting US regulatory review, the Bitcoin ETF inflows bode well for stability and performance across cryptocurrencies as an asset class.